In this issue

1101 K Street,

NW, Suite 650

Washington DC 20001

(202) 471-3962

www.insurancecompact.org

Follow us on Social Media!

LinkedIn: @Insurance-Compact

Twitter: @InsCompact

Letter from Karen Schutter, Executive Director

Greetings from the Compact! Spring is finally upon us, and I am ready for the warmer weather and spending more time outside. I hope you have time to enjoy this wonderful time of year.

In lieu of an in-person meeting at the NAIC’s Spring meeting, the Commission will meet virtually on April 1 via WebEx. You can find more information on the Events page.

The Compact Officers will be holding their seventh Compact roundtable event on the afternoon of Tuesday, May 13, the day before the 2025 NAIC Commissioner Fly-In in Washington, D.C. It will be another great opportunity for Commissioners to dialogue with state legislators, industry, and consumer representatives about the Compact and its strategic direction. If you plan to be in D.C. for the 2025 NAIC Commissioner Fly-In, please consider attending this event! The Compact can also provide funding for regulators, consumer representatives and state legislators. If you plan to be in D.C. for the 2025 NAIC Commissioner Fly-In, please consider attending this event! RSVP by April 9, 2025 if you plan to attend by completing the Compact Roundtable Form.

I am very pleased to announce our spring webinar series begins on April 2. The schedule was released earlier this month, and we have tailored sessions to member state regulators and industry filers. Popular sessions, like Navigating Compact Information and Mix and March, are coming back, and we are offering new sessions as well. A list of the April sessions can be found below or visit the Events page for more information.

Lastly, during the weekend of March 1, the SERFF Team, Compact Office, states and filers were ready to migrate the Compact filings from SERFF Legacy to the new SERFF. I am pleased to report the migration and the implementation went exceptionally smooth. The coordination and communication of the SERFF team during this weekend was orderly and successful. We continue to work with the SERFF team to make functionality improvements that will benefit our states when they are implemented.

We are grateful for the opportunity to serve our members, and we are here to provide whatever support they need.

Member Corner

For this edition, we profile Rhode Island Director Beth Dwyer!

We continue to highlight a Compact Officer. Beth Dwyer was appointed Superintendent of Insurance on Jan. 11, 2016, and named Director of Business Regulation in May 2023. Prior to this appointment, she had been employed by the Rhode Island Department of Business Regulation for 15 years, first as general counsel to the Insurance Division and later as associate director. Prior to government service, Director Dwyer was engaged in private law practice in California and Rhode Island, specializing in litigation and insurance regulation.

Director Dwyer is a member of the NAIC and is the current Vice President. She has served as chair and vice chair of various committees, task forces, and working groups and has served on the Board of Directors of the National Insurance Producer Registry (NIPR) and as an Officer of the Interstate Insurance Product Regulation Commission (Compact). She is the NAIC representative to the Financial Stability Oversight Counsel (FSOC). She is also a member of the Executive Committee, the ICS and Comparability Task Force (ICSTF), and the Strategic Plan and Financial Outlook Task Force (SPFOTF) of the International Association of Insurance Supervisors (IAIS).

Director Dwyer is a past president of the Rhode Island Women’s Bar Association. She was awarded the 2010 Rhode Island Attorney General’s Justice Award for Consumer Protection. She completed an Executive Education Program at Harvard University, John F. Kennedy School of Government Executive Education. She was the recipient of the 2023 Raymond G. Farmer Award for Exceptional Leadership from the NAIC.

Director Dwyer holds the designations of Chartered Property Casualty Underwriter (CPCU) from The Institutes, Chartered Life Underwriter (CLU) from The American College, and Senior Professional in Insurance Regulation (SPIR) from the NAIC. She was admitted to practice law in California, Rhode Island, Massachusetts, the Federal District Courts of California, and Rhode Island and the Ninth Circuit Court of Appeals. She earned a JD from Pepperdine University and a BA in Political Science and Public Administration from Providence College.

Committee Updates

Product Standards Committee

The Product Standards Committee (PSC) met in a regulator-only meeting on March 18. Committee members and interested regulators finalized several Uniform Standards for an upcoming public call:

- Additional Standards for Waiver of Premium Benefits for Total Disability and Other Qualifying Events for Term Life Insurance Policies and Certificates

- Uniform Standards For Riders, Endorsements Or Amendments Used To Effect Group Annuity Life Insurance Contract Changes

- Uniform Standards For Riders, Endorsements Or Amendments Used To Effect Group Annuity Certificate Changes and Additional Standards For Forms Used To Provide Tax Qualified Plan Provisions For Group Annuity Contracts and Group Life Policies

- Group Fixed Annuity Contract Uniform Standards, Group Annuity Certificate Uniform Standards and Uniform Standards for Group Guaranteed Interest Contracts for Non-variable Annuities to allow for nonemployer groups

More details of the amendments recommended by the PSC can be found within the Call Summary. A public call will be scheduled for May 6.

Management Committee

The Management Committee met on March 18. Members voted to adopt the workplans and charters of the following committees: Finance, Product Standards, and Rulemaking. The Management Committee also adopted the minutes from the November 2024 Joint Meeting of the Management Committee and Legislative Committee and the November 2024 Joint Meeting of the Management Committee and the Commission.

Adjunct Services Committee

The Adjunct Services Committee met in a regulator-only meeting on March 20. Committee members and interested regulators reviewed 2024 committee accomplishments, such as implementing monthly member calls to keep regulators apprised of the Compact’s filing review activities and developing product training for member states. The Adjunct Services Committee continues its work towards developing a Compact Advisory Services Office Framework, and it adopted its charter and workplan during this meeting. The Adjunct Services Committee will next meet the end of April.

Rulemaking Committee

The Rulemaking Committee met in a regular-only meeting on March 11. Committee members and interested regulators discussed two projects the Rulemaking Committee will work on in 2025: the first is a proposed accelerated rulemaking process for amending existing Uniform Standards, and the second is a proposed appeals procedures for filers to challenge Compact decisions regarding compliance with Uniform Standards. Members also adopted the committee’s workplan and charter.

Finance Committee

The Finance Committee met in a regulator-only meeting on March 12. Committee members and interested regulators heard an update regarding the Compact’s financial position for year-end 2024 and to begin 2025. Members also adopted the committee’s workplan and charter.

Spring Webinar Series

The Compact Office is excited to kick off the Spring 2025 Insurance Compact Webinar series! You will find below the April sessions geared towards member state regulators. All sessions will be recorded and available on Member Connect for on demand viewing. For more information about each session, check out the Events page.

April Sessions:

Open to All – Compact 101

Wednesday, April 2nd at 1:30 pm ET / 12:30 pm CT / 11:30 am MT / 10:30 am PT / 9:30 am AKT

Open to All – Non-Employer Groups

Wednesday, April 9th at 1:30 pm ET / 12:30 pm CT / 11:30 am MT / 10:30 am PT / 9:30 am AKT

Open to All – Navigating Compact Information

Wednesday, April 16th at 1:30 pm ET / 12:30 pm CT / 11:30 am MT / 10:30 am PT / 9:30 am AKT

Open to All – Creating and Amending Uniform Standards

Wednesday, April 30th at 1:30 pm ET / 12:30 pm CT / 11:30 am MT / 10:30 am PT / 9:30 am AKT

Legislative Spotlight

Meet West Virginia Representative Dean Jeffries!

Dean Jeffries is a member of the West Virginia House of Delegates, representing District 61. Born on September 29, 1971, in Charleston, West Virginia, he earned a Bachelor’s degree in Healthcare Administration from the University of Charleston. Before entering politics, Jeffries worked as an area manager for Sun Healthcare and currently as an insurance agent/registered representative for the largest property and casualty insurer in the nation. Dean is married to his wife Stacey. They have four children and two grandchildren.

He was appointed to the House of Delegates in September 2018 and has since been continuously re-elected. During his tenure, he has served as Assistant Majority Leader, and is on the House Health and Human Resources Committee and the House Banking and Insurance Committee. Dean currently serves at the Chairman of the Healthcare Regulation Committee and Chairman of the Joint Committee on Flooding. Jeffries is also known for his involvement in community activities, such as coaching at local schools.

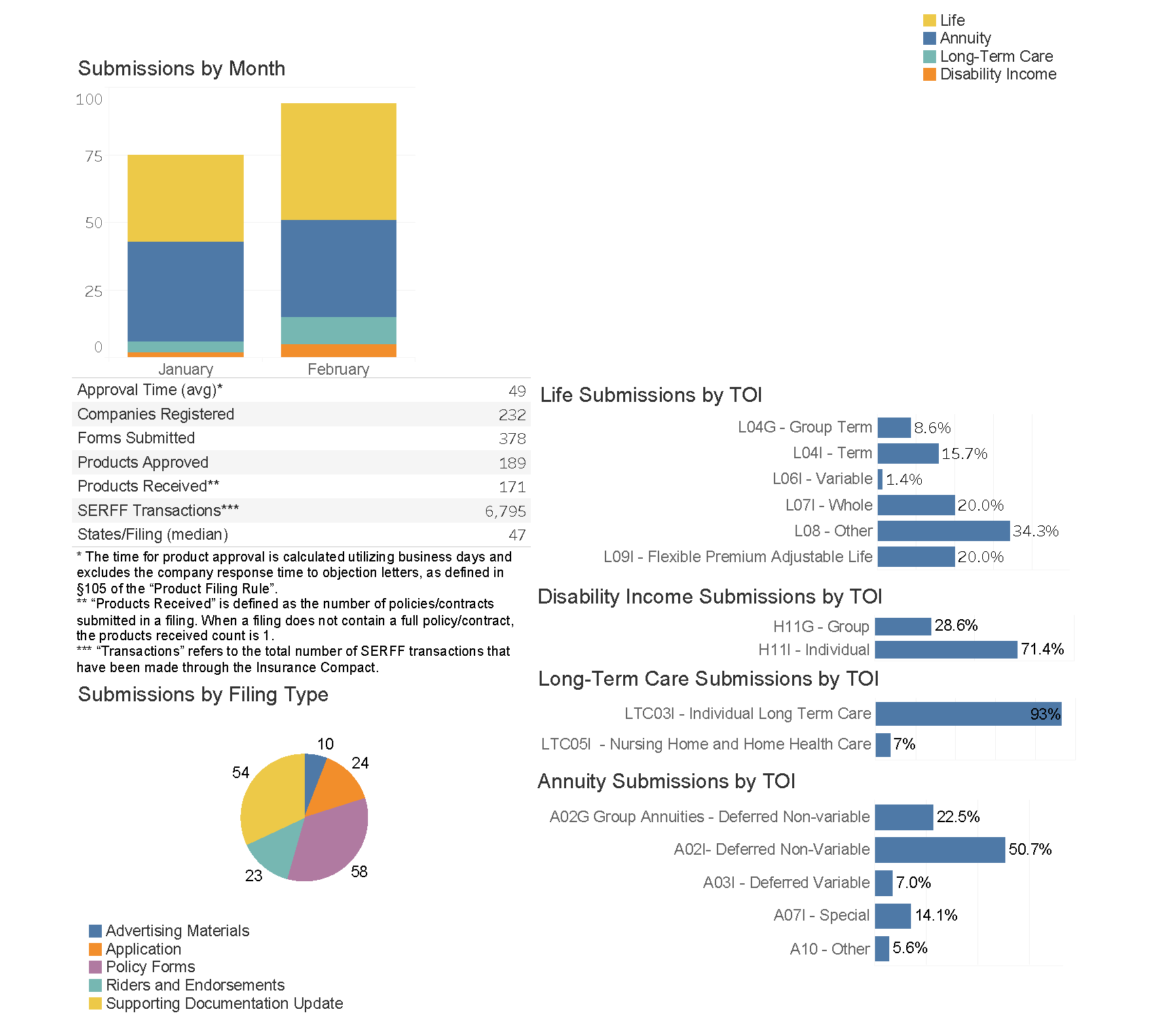

Compact Product Filing Statistics

As of February 28, 2025