In this issue

1101 K Street,

NW, Suite 650

Washington DC 20001

(202) 471-3962

www.insurancecompact.org

Follow us on Social Media!

LinkedIn: @Insurance-Compact

Twitter: @InsCompact

Letter from Karen Schutter, Executive Director

Greetings from the Compact! Let’s dive right into the big event that happened this month: the Compact Roundtable! On May 13, the Compact Officers hosted a Roundtable in Washington, D.C. with over 50 participants, including Commissioners and regulators from 13 states. The event featured breakout discussions and live polling. A full recap is below.

The Compact Office will issue reports to Compacting States regarding all companies registered in 2024 and 2025 to validate their licensing information. The new SERFF was designed to verify Compact registration details against licensing data provided by the Compacting States to the NAIC. However, this functionality has not been fully implemented due to concerns about data quality. The Compact Office will distribute these reports to the designated representatives on or around June 1, requesting a response by June 15.

I would also like to communicate a change to the emails you receive from the Compact Office: we utilize the same email system as the NAIC, and the contract with the current provider ends on June 1, as the system is at the end of its useful life. Therefore, we will move to another e-mail distribution system starting on June 2. One key difference is the emails you receive will no longer have attachments; the system can only accommodate hyperlinks. This will not impact any public notices you receive; however, regulator-only materials will no longer have attachments. Please email the Compact Office if you have any questions about this transition.

We are grateful for the opportunity to serve our members, and we are here to provide whatever support they need.

Member Corner

For this edition, we profile Arkansas Insurance Commissioner Alan McClain!

On April 3, 2020, Governor Asa Hutchinson appointed Alan McClain as Arkansas Insurance Commissioner. McClain began his career in state government in 1992 with the Arkansas Insurance Department after working with Sedgwick Insurance Group. He worked for the Arkansas Workers' Compensation Commission for 13 years and was the CEO of that Commission for almost nine years.

Most recently, McClain served as Commissioner of the Arkansas Rehabilitation Services (ARS). In this role, which he assumed in 2015, he administered the day-to-day operations of ARS, which administers the Federal Vocational Rehabilitation Act.

McClain has also served on the Arkansas Workforce Development Board and the Governor's Council on Developmental Disabilities. He is a past president of the International Association of Industrial Accident Boards & Commissions and the Council of State Administrators of Vocational Rehabilitation.

He holds an undergraduate degree from Hendrix College and a master's in Public Administration from the University of Arkansas at Little Rock.

Compact Roundtable Recap

The Washington D.C. Roundtable served as a collaborative forum for regulators, industry representatives, Compact staff, and others to reflect on the current state of the Insurance Compact and to explore avenues for its evolution. Participants expressed strong appreciation for the Compact’s role in streamlining the insurance product filing process across multiple jurisdictions. The “one-stop” review system was repeatedly praised for its efficiency, consistency, and the depth of expertise it brings to regulatory review. Many noted that the Compact not only accelerates speed to market but also alleviates the burden on individual state resources, allowing for more focused and expert-driven evaluations. Communication between filers and Compact staff was highlighted as a major strength, with pre-filing consultations and responsiveness contributing to a smoother process.

Despite these strengths, the Roundtable also surfaced several areas where stakeholders believe the Compact could improve. Chief among these were concerns about sufficient staffing given the heavy workload, which have led to longer review times, and the need for more robust training for both regulators and industry professionals, particularly around new or evolving Uniform Standards. Participants also discussed the challenges of accommodating new insurance products within the current regulatory framework. There was a strong call for more flexible standards and a clearer, more transparent objection and appeals process. Many suggested that the Compact could serve not only as a regulatory body but also as a consultative partner in the review of new products.

A significant portion of the discussion focused on the proposed Compact Advisory Services Option (CASO), a pilot framework intended to facilitate early-stage collaboration between companies and regulators on novel product features. While the concept was met with interest, stakeholders raised questions about its implementation, including concerns about potential delays, the voluntary nature of participation, and the clarity of outcomes. Many saw it as a valuable opportunity to identify gaps in existing standards and to foster a more unified regulatory approach. The Roundtable concluded with a shared sense of purpose: to refine the Compact’s processes in ways that uphold its mission of consumer protection and regulatory efficiency, while also embracing the innovation necessary to meet the evolving needs of the insurance market.

2026 Uniform Standards Development Prioritization Reminder

The deadline for the 2026 Uniform Standards Development prioritization is fast approaching! If you have suggestions for new or amended Uniform Standards, please identify them by using the Request for New Uniform Standards or Changes to Uniform Standards webform. Those submitted by July 1 will be considered for the 2026 Uniform Standards Development prioritization. Also, as a friendly reminder, you can only submit one product suggestion at a time; we are unable to accommodate multiple product suggestions in one form. If you have any questions about this process, please email comments@insurancecompact.org.

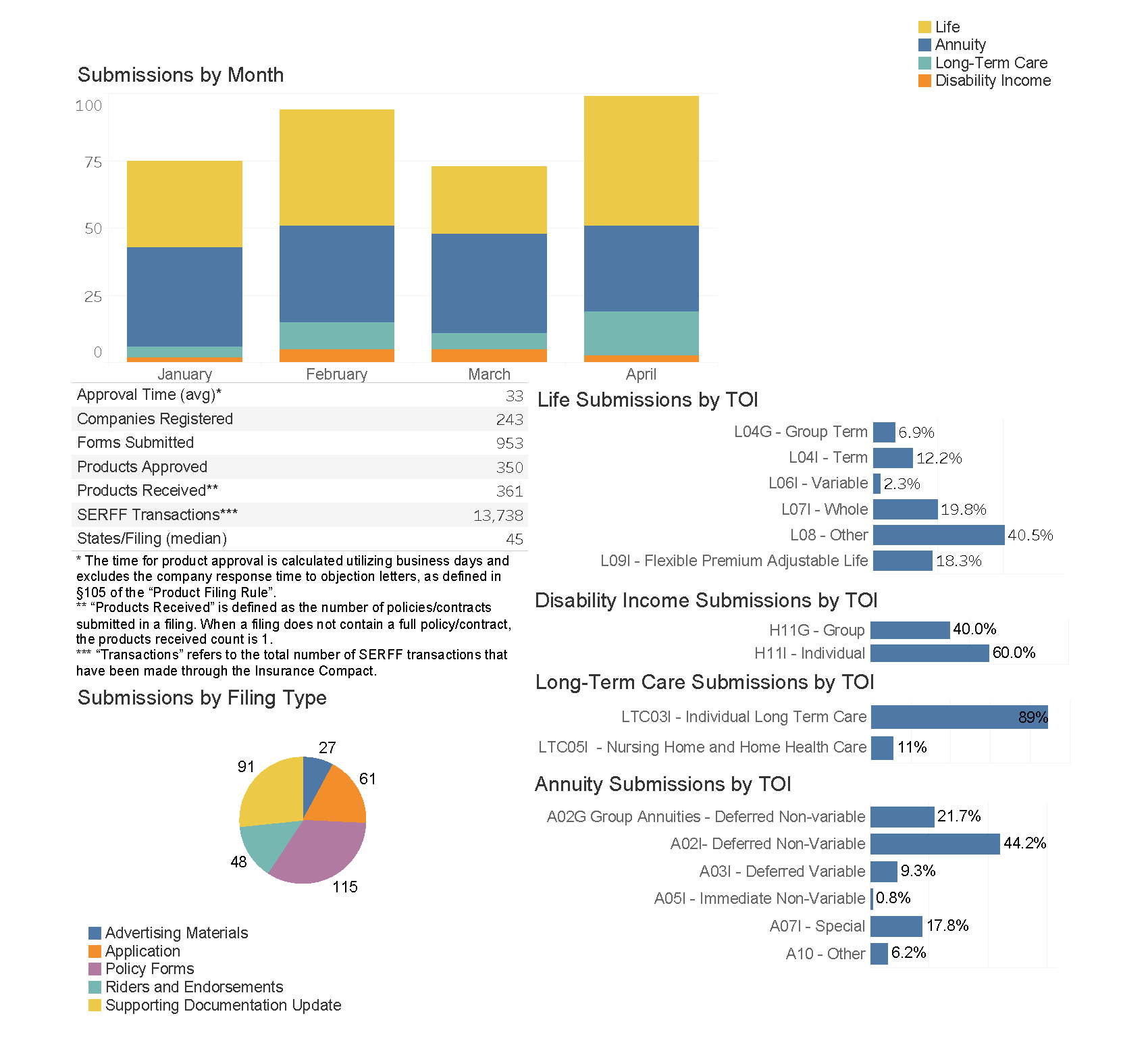

Compact Product Filing Statistics

As of April 30, 2025