In this issue

1101 K Street,

NW, Suite 650

Washington DC 20001

(202) 471-3962

www.insurancecompact.org

Follow us on Social Media!

LinkedIn: @Insurance-Compact

Twitter: @InsCompact

Letter from Karen Schutter, Executive Director

Greetings from the Compact! June holds special significance for us—it marks our anniversary month! Our very first meeting took place on June 13, 2006, in Washington, D.C., with 27 members present. Fast forward 19 years, and we’re proud to now count 48 members among us. It’s incredible to think that next year will be our 20th anniversary—a milestone truly worth celebrating!

This is a friendly reminder that we are still seeking input on two important items: first, if you have suggestions for new or amended Uniform Standards, please identify them by using the Request for New Uniform Standards or Changes to Uniform Standards webform. The deadline for the 2026 Uniform Standards Development prioritization is Tuesday, July 1.

Second, the Product Standards Committee is also seeking feedback regarding amendments to the Uniform Standards for Waiver of Premium and Waiver of Surrender Charges for Life Policies and Annuity Contracts. Written comments should be submitted to comments@insurancecompact.org by close of business on Friday, August 1. More information about the requested information can be found in this issue.

Additionally, the Compact Office sent notice of publication and comment for several new and amended Group Annuity and Group Life Uniform Standards. The Management Committee will accept written comments until Friday, August 8. More information about these amendments can be found on the Insurance Compact's Docket Developing Standards page.

We are grateful for the opportunity to serve our members, and we are here to provide whatever support they need.

Member Corner

For this edition, we profile Oklahoma Insurance Commissioner Glen Mulready!!

Glen Mulready serves as Oklahoma’s 13th insurance commissioner. A former state legislator and longtime insurance professional, he was recently unopposed in his bid for reelection, and will start a second term as insurance commissioner in 2023. Commissioner Mulready was first elected to the state-wide position in 2019.

Commissioner Mulready started his insurance career as a broker in 1984 and later served in executive roles for Oklahoma’s two largest health insurance companies. In 2010, Mulready entered public service and was elected to represent West Tulsa, Jenks, and Glenpool in the Oklahoma House of Representatives. During his tenure in the house, Commissioner Mulready became a policy leader on many transformative insurance issues and held several roles, including, Insurance Committee chair and House Majority Floor Leader. In 2011, Governing Magazine named Mulready one of 17 “GOP Legislators to Watch Nationally.”

As Commissioner, Mulready has led initiatives to increase the number of health insurance carriers available to Oklahomans, bring more attention to consumer education, and remove burdensome regulation in the department’s administrative code. Since 2019, the Oklahoma Insurance Department has recovered over $20 million for Oklahoma consumers. Commissioner Mulready supports efforts to continue to apply best practices, modernize the department and embrace new technology to serve the people of Oklahoma better.

As a firm believer in the free market and a longtime advocate for affordable health care for all Oklahomans, Commissioner Mulready believes creating more choices for consumers will help reduce the number of uninsured Oklahomans and improve affordability in the insurance market. When he was first elected, only two plan options were available in the Oklahoma Health Insurance Marketplace. Currently, seven insurers are now offering products to Oklahoma consumers.

Moreover, Commissioner Mulready sponsored the original Insurance Business Transfer (IBT) Act, now law and is recognized as one of the most innovative insurance regulations in the country. Since 2020, the first two IBT transactions in United States history were completed in Oklahoma. In addition, Oklahoma is also focused on recruiting Captive Insurance domiciles. Over one-third of currently licensed captives came to Oklahoma during Commissioner Mulready’s first two years in office.

Commissioner Mulready and Sally, his wife of 34 years, are the proud parents of three college-aged sons: Sam, Jake, and Will. Commissioner Mulready is very active in the community, having served on numerous boards and committees, including Big Brothers Big Sisters, the Juvenile Diabetes Research Fund, March of Dimes, Shepherds Fold Ranch Christian Summer Camp, Crime Commission and Tulsa Tough. Commissioner Mulready and his wife were the recipients of Leadership Tulsa’s Paragon Award for their work with Big Brothers Big Sisters in 2018.

Committee Updates

Product Standards Committee (PSC)

The PSC held a regulator-only call on June 17, 2025, to discuss several key agenda items. One major topic was the recent Request for Comments regarding the expansion of waiver triggers for premium and surrender charges in life and annuity products. The Request for Comments, prompted by requests from filing companies, will gather information for the PSC as it considers amending the list of triggers for waiver of premium and waiver of surrender charges in the applicable life insurance and annuity uniform standards.

The committee also reviewed a draft for new standards concerning bonus benefits in individual adjustable life insurance policies. The draft standard is based on a similar standard for individual annuity products. The actuarial aspects will be developed by the Actuarial Working Group. Additionally, the Compact Office proposed an amendment to limit accidental death benefits to no more than three times the all-cause death benefit, which received no comments or questions from committee members. The next regulator-only meeting is set for July 1, 2025.

Adjunct Services Committee

The Adjunct Services Committee met in a regulator-only meeting on June 12. The meeting centered on developing a pilot program framework designed to enhance collaboration between insurers, regulators, and participating states. The discussion reflected positive feedback from a recent Compact Roundtable, where stakeholders generally supported the proposed framework. Insurers expressed a willingness to participate but raised concerns about maintaining confidentiality throughout the process. There was also mixed feedback regarding the pilot’s implementation and approval procedures, indicating a need for further refinement and clarity.

Key elements of the pilot program include eligibility criteria that prioritize companies familiar with Compact processes and those with a history of product filings. The group discussed strategies for recruiting state participation, emphasizing the importance of clear and consistent communication to encourage involvement. All states will be notified of pilot program filings, ensuring transparency. Additionally, the meeting addressed potential resource challenges for regulators, especially during peak filing periods, and introduced a life insurance training program aimed at supporting new regulators. Overall, the Compact aims to streamline regulatory interactions and foster a more efficient, collaborative environment.

The Adjunct Services Committee plans to expose this proposal for a public call in early August.

Rulemaking Committee (RMC)

The June 11, 2025, RMC regulator-only call focused on refining and accelerating the rulemaking process. The committee finalized the draft provision for a Direct Final Rule (§110), confirming that existing safeguards—such as the 10-day legislative notice and the 90-day publication period—would remain intact. With no objections, the committee agreed to expose the draft for public comment. They also discussed ways to expedite rulemaking, noting that using sub-groups and industry-provided draft standards has proven effective. The Compact Office highlighted the existing §103 Notice of Potential Rulemaking as a valuable tool for early public and industry input, which the committee recommended leveraging instead of amending current rules.

Further discussions addressed the appeals process and the use of advisory opinions. The committee reaffirmed that appeals can only occur after a formal disapproval, which has not yet happened, making further changes to the appeals procedure unnecessary. Instead, members supported using the existing Operating Procedure for the Issuance of Advisory and Interpretive Opinions, which functions similarly to IRS private letter rulings. The Compact Office clarified that while the Executive Director oversees drafting, final approval rests with Commission members. The meeting concluded with scheduling notes for upcoming calls and no additional matters raised.

The RMC will hold a public call on July 30.

Waiver Amendments

The PSC is requesting comments about amending the categories to expand the triggers for Waiver of Premium or Waiver of Surrender Charges in the applicable Life Insurance and Annuity Uniform Standards.

The PSC is seeking input on the following questions:

- Are companies filing riders with states to allow Waivers of Premium or Surrender Charges for certain financial hardship situations?

- Are there specific categories of financial hardship that the PSC should consider if amending the standards?

- Are companies filing riders with states to allow waivers due to changes in the federal tax code?

- Are companies filing riders with states to allow waivers related to natural disasters such as floods, tornados, or home displacement related to disasters?

- Are there other categories that should be permitted as waiver triggers and if so, why?

- Do these categories change if it is a Waiver of Premium or a Waiver of Surrender Charge benefit?

- Do these categories change if the waiver is attached to a life insurance or an annuity product?

- What are the reasons companies are expanding beyond traditional triggers in Waiver of Premium or Surrender Charge benefits?

- The PSC welcomes comments on how the companies address states’ concerns, if any, that the risk triggering the benefit may be outside of the state’s definition of life insurance and/or annuity business.

- Are these additional categories (home displacement, financial hardship, changes in the federal tax code) available in the marketplace today?

Please submit your comments to comments@insurancecompact.org by Friday, August 1. The PSC will hold a public call to discuss the comments on August 5, 2025.

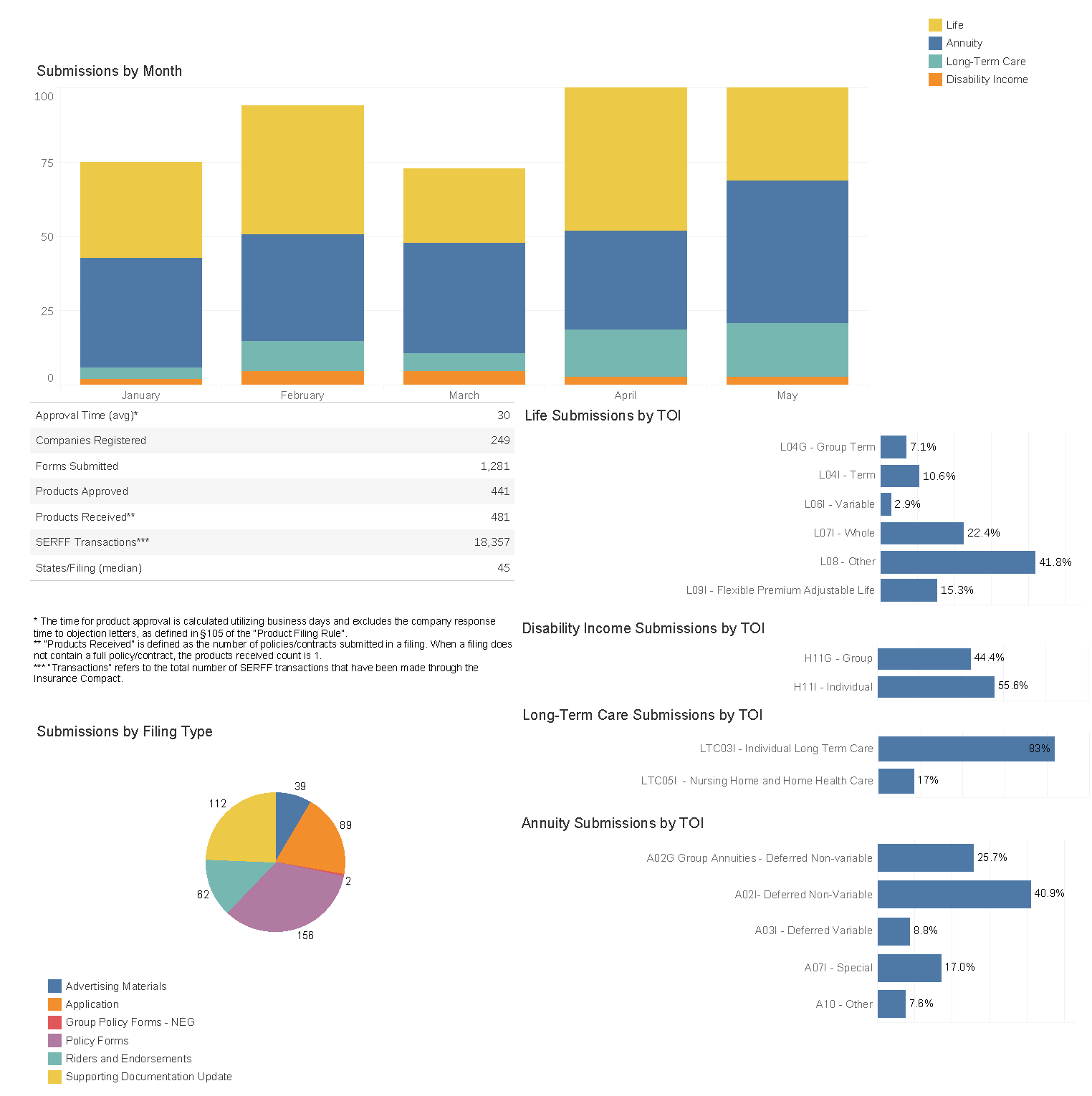

Compact Product Filing Statistics

As of May 31, 2025