In this issue

1101 K Street,

NW, Suite 650

Washington DC 20001

(202) 471-3962

www.insurancecompact.org

Follow us on Social Media!

LinkedIn: @Insurance-Compact

Twitter: @InsCompact

Letter from Karen Schutter, Executive Director

Greetings from the Compact! We had a great meeting in Minneapolis, with several important initiatives moving forward, and I am pleased to say the Insurance Compact has a new Treasurer! Nebraska Department of Insurance Director and Insurance Compact Chair Eric Dunning announced the appointment of Maryland Insurance Commissioner Marie Grant to serve as Treasurer for the remainder of 2025. In case you missed it, we have a recap of the meeting in this issue.

The next Compact Roundtable is on Wednesday, November 5, the morning after Insurtech on the Silicon Prairie (ISP) in Omaha, NE. More details are in this issue. We are looking forward to a great discussion!

The Compact Office distributed a memo regarding amendments to the Standards for Accidental Death Benefits and Additional Standards for Accidental Death and Dismemberment Benefits for individual life insurance policies. The memo provides more detail about the proposal and reflects guidance previously outlined in Filing Information Notice 2023-2. These changes would codify the ratio that the Compact Office has been applying such that the accidental death benefit could not be more than three times the all-cause death benefit. This change aligns with current Compact Office review practices to address the issue that the accidental death benefit is in addition, and not a standalone benefit, in the Uniform Standards. The Product Standards Committee reviewed this proposal during a public call on August 5, 2025, and written comments are now open until Friday, October 3, 2025. Please send your comments on the reasonableness of the proposed 3:1 ratio to comments@insurancecompact.org. For more information, visit the Product Standards Committee page of the Compact’s website.

Lastly, I am pleased to announce the Compact Office will roll out a five-part life insurance training program this fall! These sessions are geared towards new and entry-level rate & form filing regulators working in Compacting member state insurance departments. We will send a notice announcing the fall schedule in the coming weeks, with the goal of making them available on NAIC Compass system next year.

We are grateful for the opportunity to serve our members, and we are here to provide whatever support they need.

Member Corner

For this edition, we profile Alabama Insurance Commissioner Mark Fowler!

Mark Fowler was appointed as Alabama’s Acting Commissioner by Gov. Kay Ivey on July 1, 2022. He was appointed Commissioner effective January 16, 2023.

As chief administrator for the Alabama Department of Insurance (DOI), Commissioner Fowler leads the DOI in fulfilling its mission to serve the people of Alabama by regulating the insurance industry, providing consumer protection, promoting market stability, and enforcing state fire safety standards and laws. During Mark’s tenure as legislative liaison, the Department has been successful in enacting more than forty (40) bills plus assisting in the enactment of several industry sponsored bills that were supported by the Department. In his role as Commissioner of Insurance, he also serves as a member of the Alabama Securities Commission.

Commissioner Fowler joined the DOI in February 2013, previously serving as Deputy Commissioner/Chief of Staff. Before joining the DOI, he worked for 28 years in government and public affairs, as well as association management, both at the state and federal levels. Commissioner Fowler served 17 years as an association executive director in Alabama, working with industries such as chemical manufacturing, cable/broadband telecommunications, and agribusiness. He also worked for five years in the Washington, DC, area, first as a legislative assistant to the late Sen. Howell Heflin and then as a congressional liaison for Rockwell International, a major defense and aerospace company.

Aside from his professional career, Commissioner Fowler is a co-host of the Bluegrass Revival Jam, a bluegrass music event in Montgomery, AL. He also served as a board member and treasurer of Legacy, Partners in Environmental Education, and as a board member of the Alabama Civil Justice Reform Committee. He is past president of the Auburn University Montgomery Alumni Association and former host of a weekly gospel music radio program.

Commissioner Fowler earned a master’s degree in political science from Auburn University at Montgomery and a bachelor’s degree in broadcast communications from Auburn University (Auburn, AL).

Summer National Meeting Recap

Commissioner McVey introduced nine uniform standards for consideration, including six new standards and three amendments to existing group annuity standards. The new standards addressed gaps in group life and annuity products, while the amendments aimed to expand usage to non-employer groups. The American Council of Life Insurers (ACLI) raised concerns about the definitions of employer and non-employer groups, citing potential conflicts with federal law (ERISA). Director Dunning proposed adopting the following six new standards, which were supported and passed by two-third majority roll call vote of the Management Committee and Commission:

- Uniform Standards for Riders, Endorsements or Amendments Used to Effect Group Annuity Contract Changes

- Uniform Standards for Riders, Endorsements or Amendments Used to Effect Group Annuity Certificate Changes

- Additional Standards for Forms Used to Provide Tax Qualified Plan Provisions for Group Annuity Contracts

- Additional Standards for Graded Death Benefit for Group Term Life Insurance Policies and Certificates

- Additional Standards for Waiver of Premium Benefits for Total Disability and Other Qualifying Events for Group Term Life Insurance Policies and Certificates

- Additional Standards for Forms Used to Provide Tax Qualified Plan Provisions for Group Life Insurance Policies

The Compact Office anticipates promulgating the adopted standards on September 2, and the effective date for filing is December 1.

Director Dunning also suggested tabling the amendments to the group annuity uniform standards for further review. The Compact Office will prepare a memo on retirement plan definitions for further discussion.

Rulemaking Committee Chair Jill Kruger (SD) presented the committee’s recommendation to amend the rulemaking process to allow for expedited adoption of non-controversial changes. Director Dunning emphasized the need for improved procedures to appeal product filing decisions and proposed referring this specific issue back to the committee for further development. The motion to expose the amendment to the Rulemaking Rule and refer the appeals issue back to the committee passed by voice vote of the Management Committee.

Adjunct Services Committee Chair Barbara Richardson reported on the committee’s progress in developing the Consultation Advisory Services Office (CASO), a voluntary framework to support states and companies with pre-filing consultations. A pilot program will begin in September, with a final recommendation expected in December. Legislators expressed support for the CASO’s direction.

Karen Schutter delivered the Executive Director’s report highlighting staff changes, including the appointment of Dan Bradford as Director of Regulatory Affairs and several internal promotions. She discussed ongoing efforts to improve the SERFF system, training programs for regulators, and outreach initiatives.

The Commission approved stay extensions for Oregon and North Dakota. Oregon received a six-month extension to finalize its opt-out regulations for certain annuity standards, while North Dakota was granted a one-year extension to address concerns with disability income standards.

Arizona shared that it successfully passed legislation to opt back into the Compact for long-term care products, with gratitude expressed to the Compact staff for their support.

Meeting Highlights

Save the Date!

Mark your calendars! The Compact Officers will be holding its eighth Roundtable event on Wednesday, November 5, the morning after the ISP program in Omaha, NE. If you are attending the ISP, please consider staying one more day to attend this exciting event! We have limited funding for any state regulators interested in attending.

If you plan to be in Omaha for ISP, please consider attending this event by completing the Compact Roundtable Form by October 3, 2025. Space is limited, so sign up early!

If there are any questions regarding this event, please contact the Insurance Compact Office.

Compact Spotlight

Meet Jenny Sieben!

Jenny joined the Compact Office in July 2024 after spending 23 years with an insurance company. Her responsibilities at the Insurance Compact include reviewing forms for compliance with the Uniform Standards in individual life, annuity, and long-term care. Jenny has achieved her FLMI, AIRC, and ACS designations from LOMA.

Jenny and her husband Dean live in Minnesota with their 2 cats, Pekka and Shadow. In her spare time, you will find her at a concert, especially if Styx is in town, or cheering on the Minnesota Wild. She also enjoys traveling, hiking, and talking hockey with anyone who will listen.

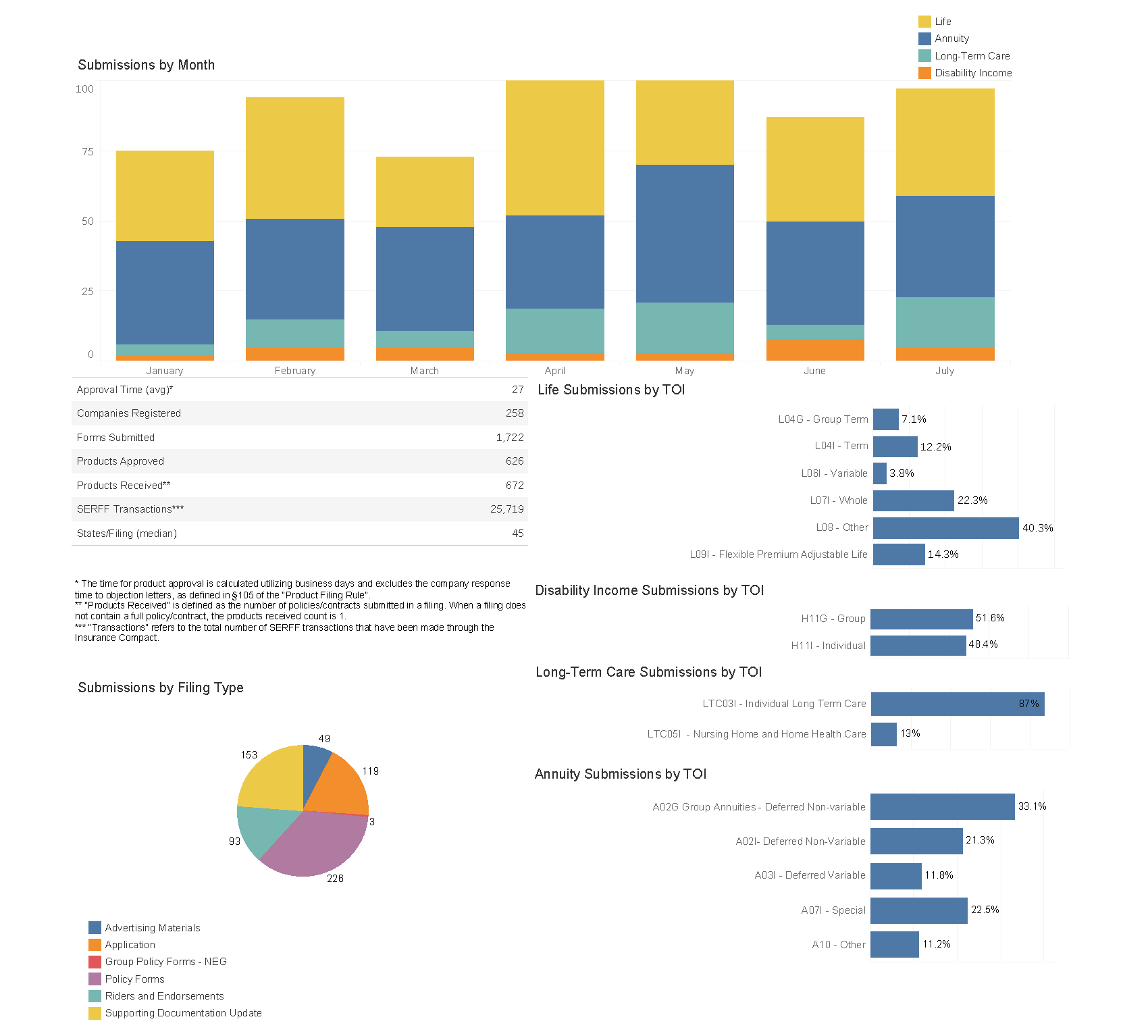

Compact Product Filing Statistics

As of July 31, 2025