In this issue

1101 K Street,

NW, Suite 650

Washington DC 20001

(202) 471-3962

www.insurancecompact.org

Follow us on Social Media!

LinkedIn: @Insurance-Compact

Twitter: @InsCompact

Letter from Karen Schutter, Executive Director

Greetings from the Compact! As September winds down and the leaves begin to fall, we’re reminded that this season isn’t just about change, it’s about momentum. Much like autumn’s quiet transformation, the energy and ideas sparked during our Roundtable events are coming together to advance key initiatives.

Looking ahead, have you registered for the next Compact Roundtable? There’s still time! The Insurance Compact Officers will host the Roundtable in Omaha, NE on Wednesday, November 5, from 9:00 a.m. to 12:00 p.m. CT—the day after Insurtech on the Silicon Prairie (ISP). If you plan to attend, please RSVP no later than October 3 using the Compact Roundtable Form. Don’t miss this valuable opportunity to connect, collaborate, and engage directly with fellow regulators and Compact leadership—sign up today!

The Product Standards Committee (PSC) is actively seeking stakeholder input on two key initiatives: proposed amendments to the Accidental Death and Accidental Death and Dismemberment Benefits standards and the 2026 Uniform Standards Identification List. Both are key to shaping the Compact’s work ahead, and your feedback really matters. If you haven’t sent in comments yet, there’s still time—October 3 is the deadline. You’ll find all the details and how to get involved further down in this issue.

We’re already gearing up for the Compact’s Annual Meeting this December in Hollywood, FL! The annual budget and Uniform Standards Development processes are underway, and public calls for the Product Standards and Finance Committees are scheduled for October, offering stakeholders an opportunity to provide input. Look for notice of the Management Committee meeting scheduled for October 30, where key priorities for the Annual Meeting will be previewed and discussed.

We are grateful for the opportunity to serve our members, and we are here to provide whatever support they need.

Member Corner

For this edition, we profile Indiana Insurance Commissioner Holly W. Lambert!

Holly W. Lambert was appointed as Commissioner of the Indiana Department of Insurance (IDOI) by Gov. Eric Holcomb and assumed her role on Oct. 16, 2024. As Indiana’s chief insurance regulator, Commissioner Lambert is committed to upholding the statutory responsibilities of the department and ensuring the effective execution of its mission to protect and inform all Hoosiers while ensuring a strong insurance market.

Commissioner Lambert has spent much of her career in public service. She served as a market conduct attorney in the IDOI Enforcement Division and went on to serve as deputy general counsel, chief deputy commissioner of the Consumer Protection Unit, general counsel of the IDOI, and ultimately as chief of staff for the department. She has worked with the NAIC serving as a member of the Market Analysis Procedures (D) Working Group and the collaborative action designee (CAD), as well as the market analysis chief for Indiana, acting as the NAIC’s primary contact for all market conduct regulation and examination functions.

Commissioner Lambert earned a Juris Doctor (J.D.) from Western Michigan University Thomas M. Cooley Law School (Lansing, MI) and a bachelor’s degree in English literature from Purdue University (West Lafayette, IN).

The IDOI protects Indiana's insurance consumers by monitoring and regulating the financial strengths and market conduct activities of insurance companies and agents. The department monitors insurance companies and agents for compliance with state laws to protect consumers and offer them the best array of insurance products available. The department also assists Hoosiers with insurance questions and provides guidance in understanding how insurance policies work.

Life Training Schedule

The Compact Office is excited to launch its first insurance product training program: the Life Insurance Product Training Series. Designed for entry-level regulators or those seeking a refresher, this free webinar series offers practical insights into life insurance product review, including regulatory requirements and basic insurance forms and contracts. We are offering the following five presentations: 101: Regulating Life Insurance, Life Insurance Applications, Term & Whole Life Insurance, Universal Life (UL) & Variable Universal Life (VUL) Insurance, and Additional Life Benefits.

Sessions reference Compact Uniform Standards but are applicable to all rate and form regulators. Each 60-minute webinar includes Q&A, is offered twice this season via WebEx, and will be available on-demand through NAIC Connect.

This series is the first step in a broader training initiative outlined in the Compact’s strategic plan. Future training on annuities, disability income, and long-term care products will be announced at a later date. Visit the Compact’s Events page for the full schedule and share with colleagues who may benefit!

We Need Your Feedback!

The PSC is seeking input on proposed amendments to existing Uniform Standards and ideas for future development.

Accidental Death and AD&D Benefits

The PSC is currently seeking feedback on proposed amendments to the Accidental Death and Accidental Death & Dismemberment Uniform Standards, which clarify the application of benefit ratios relative to the all-cause death benefit. You can find more information about this on the Product Standards Committee page of the Compact's website.

To ensure all stakeholders have the opportunity to weigh in, the comment period has been extended to Friday, October 3. If you haven’t submitted your input yet, we strongly encourage you to do so as soon as possible. Timely feedback is essential to help shape these important updates. Comments can be submitted to comments@insurancecompact.org.

2026 Uniform Standards Identification List

The PSC has released its Uniform Standards Identification List for 2026, outlining proposed new and amended standards. This annual process invites input from regulators, legislators, insurers, consumer representatives, and other stakeholders to help shape the Compact’s strategic direction and budget planning.

Following initial public and internal review sessions, the PSC has assigned suggested priorities to the submitted requests. A second public call is scheduled for October 7, 2025, to gather feedback on these priorities.

Stakeholders are encouraged to review the list and submit written comments by Friday, October 3, 2025. Comments should be emailed to comments@insurancecompact.org.

Compact Spotlight

Compact Team Meets in Kansas City!

The Product Review Operations (PRO) and Regulatory Affairs (RAD) Divisions met last week for a multi-day session focused on improving processes, enhancing communication, and aligning priorities. The PRO team explored turnaround strategies, filer guidance, and SERFF updates, while the RAD team focused on outreach, member communication, and committee support. A joint session tackled big-picture topics like uniformity vs. flexibility, technology planning, and the launch of the Consultative & Advisory Services Office (CASO) pilot. The week was wrapped with goal setting and team-building activities that energized collaboration across the Compact.

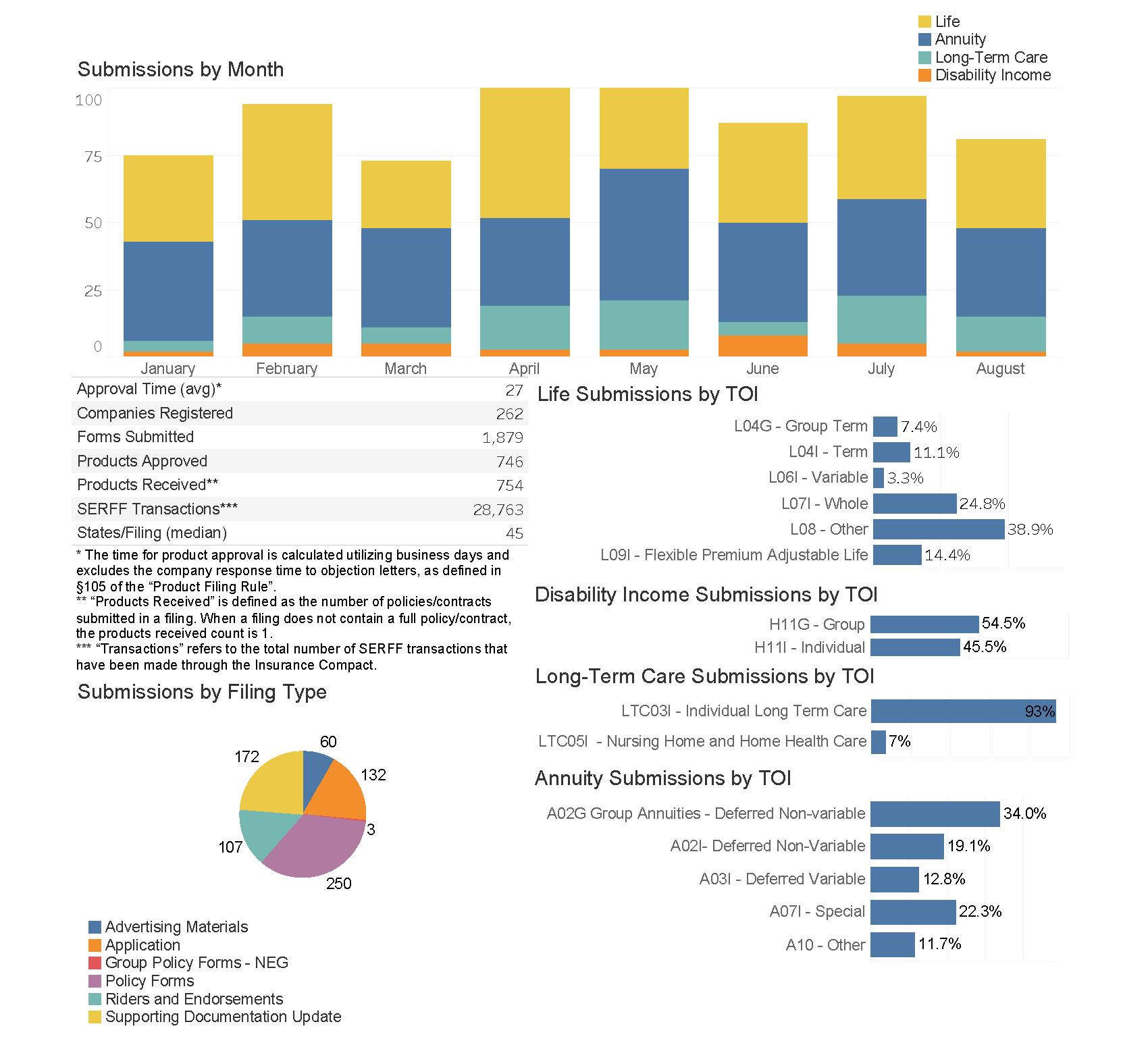

Compact Product Filing Statistics

As of August 31, 2025