In this issue

1101 K Street,

NW, Suite 650

Washington DC 20001

(202) 471-3962

www.insurancecompact.org

Follow us on Social Media!

LinkedIn: @Insurance-Compact

Twitter: @InsCompact

Letter from Karen Schutter, Executive Director

Greetings from the Compact! Halloween is tomorrow, and we’ve got plenty of treats—no tricks! From committee activities to upcoming events like the Compact Roundtable on November 5 and our Annual Meeting in Hollywood, Florida on December 10, there’s a lot to look forward to as we wrap up the year.

Can you believe the Compact Roundtable is next week? We’re so excited to meet in Omaha, NE on November 5 for our eighth Compact Roundtable event. The Compact Office circulated an agenda to attendees earlier this week, and we have an interactive, even a bit entertaining, program planned for them. We are highlighting one key initiative: the Consultation and Advisory Services Office (CASO) Pilot Program. To bring you up to speed, an overview of the CASO process is included in this issue.

Earlier this month, the Compact Office emailed all Members and Designated Representatives of the 48 Compacting States requesting committee preferences for the upcoming year. If you haven’t yet responded, please complete the Committee Preference Form by Friday, October 31 to indicate your preferred assignments and any interest in serving as a Chair or Vice Chair. The form includes descriptions of current committees—Product Standards, Rulemaking, Finance, Audit, Adjunct Services, and Governance Committees, and Actuarial Working Group. Your input ensures active member participation and effective collaboration across Compact committees.

The Insurance Compact’s Life Insurance Product Training Series is now available for on-demand viewing anytime through NAIC Connect (regulator-only platform). This free program is designed for new regulators or anyone looking for a refresher on life insurance product review. Explore five practical sessions—Regulating Life Insurance, Life Insurance Applications, Term & Whole Life Insurance, Universal Life & Variable Universal Life Insurance, and Additional Life Benefits. Log in to NAIC Connect and strengthen your expertise at your convenience!

We are grateful for the opportunity to serve our members, and we are here to provide whatever support they need.

Member Corner

For this edition, we profile Missouri Department of Commerce and Insurance Director Angela L. Nelson!

Angela L. Nelson was appointed by Gov. Mike Kehoe as Director of the Missouri Department of Commerce and Insurance (DCI), officially assuming her role on March 1, 2025. She was confirmed by the Missouri State Senate on March 13, 2025.

Director Nelson’s extensive experience spans nearly 25 years and encompasses multiple facets of the insurance sector, having served as an agent, regulator, and executive. From 2002 to 2020, she played a pivotal role within the DCI, where she held several key positions. Notably, she was the Division Director of the Insurance Consumer Affairs Division from 2009 to 2012, directing the DCI’s response to the devastating Joplin tornado. Following that role, she led the Market Regulation Division from 2012 to 2020, navigating complex regulatory landscapes and advocating for Missouri consumers.

Before her appointment as Director, she served as the Vice President of Public Affairs and Government Relations for the Automobile Club of Missouri, part of the larger Automobile Club Enterprises Group. In this capacity, she skillfully managed legislative and regulatory relationships on a diverse array of issues, including insurance, motor club operations, and traffic safety. She also worked briefly for Blue Cross and Blue Shield of Kansas City (BCBSKC), where she managed its compliance operations.

Her accolades include the Graduate College Award from William Woods University in 2012 for her contributions to Missouri insurance consumers, as well as the Paul L. DeAngelo Memorial Teaching Award from the Insurance Regulatory Examiners Society (IRES) in 2018.

Director Nelson earned a Master of Business Administration (MBA) and a bachelor’s degree in management, summa cum laude, from William Woods University (Fulton, MO).

Committee Updates

Product Standards Committee

The Products and Standards Committee met on October 21 in a regulator-only meeting to finalize the 2026 Uniform Standards Prioritization List. Regulators agreed to keep contingent deferred annuities at low-to-remove priority, noting limited market use and state opt-out concerns. A request to elevate registered index-linked variable universal life products was declined; the item remains medium and will be referred to the Actuarial Working Group. Participants agreed to consider two late submissions next year since they arrived after the July 1 deadline. The committee also sought clarification on proposed annuity language and accidental death benefit ratios before moving forward. The next regulator-only meeting is scheduled for November 18.

Finance Committee

The Finance Committee met on October 15 in a public meeting to review current financials and present the draft 2026 budget. Revenues through August were slightly below budget but significantly ahead of last year, while expenses were significantly under budget, leaving the Compact in a strong financial position. Following last year’s fee realignment, the 2026 budget proposes no new filing fees. Key priorities include filling an open actuary position and adding two new roles in mid-2026: an additional actuary to meet growing demand for complex annuity reviews and an entry-level administrative position to enhance reporting. The committee voted to recommend the full budget proposal, including the fee schedule and staffing additions, to the Management Committee. Final adoption is expected at the Compact’s Annual Meeting on December 10 in Hollywood, FL, with changes effective January 1, 2026.

Consultation and Advisory Services Office (CASO) Pilot Program

The Compact Roundtable will feature discussion on a proposed Consultation and Advisory Services Office (CASO) Pilot Program, designed to help the Compact conduct an advisory review of products that fall outside existing Uniform Standards but remain within the Compact’s authority: life, annuity, long-term care, and disability income insurance. This service would give states free access to Compact’s actuarial and product expertise, foster multi-state collaboration, and provide companies with a roadmap for compliance issues before filing state-by-state. The pilot aims to streamline reviews, improve speed-to-market, and potentially pave the way for new Uniform Standards.

Participation would be open to all Compacting States, with a goal of at least 30 states per consultation. Eligible companies must be registered with the Compact and have recent filings in the same product line. Products considered for the pilot include those previously declined for review or listed on the Compact’s prioritization list.

Compact Spotlight

Meet Cara Shackelford!

Cara Shackelford is a Regulatory Research Specialist for the Interstate Insurance Product Regulation Commission (“Insurance Compact”). Cara joined the Insurance Compact in December of 2024. Cara’s primary responsibility is to provide primary staff support to the Rulemaking Committee and Adjunct Services Committee and secondary staff support to the Product Standards Committee and Actuarial Working Group.

Before joining the Insurance Compact, Cara worked as a regulator for the North Carolina Department of Insurance for over 30 years, reviewing life, annuity, and credit insurance filings. Prior to working for the state of North Carolina, Cara drafted pension contracts and then worked in the legal division for Aetna Life Insurance Company in Connecticut.

Cara is a graduate of the University of Notre Dame in South Bend, Indiana. Cara received a B.A. with a dual major in Government and History.

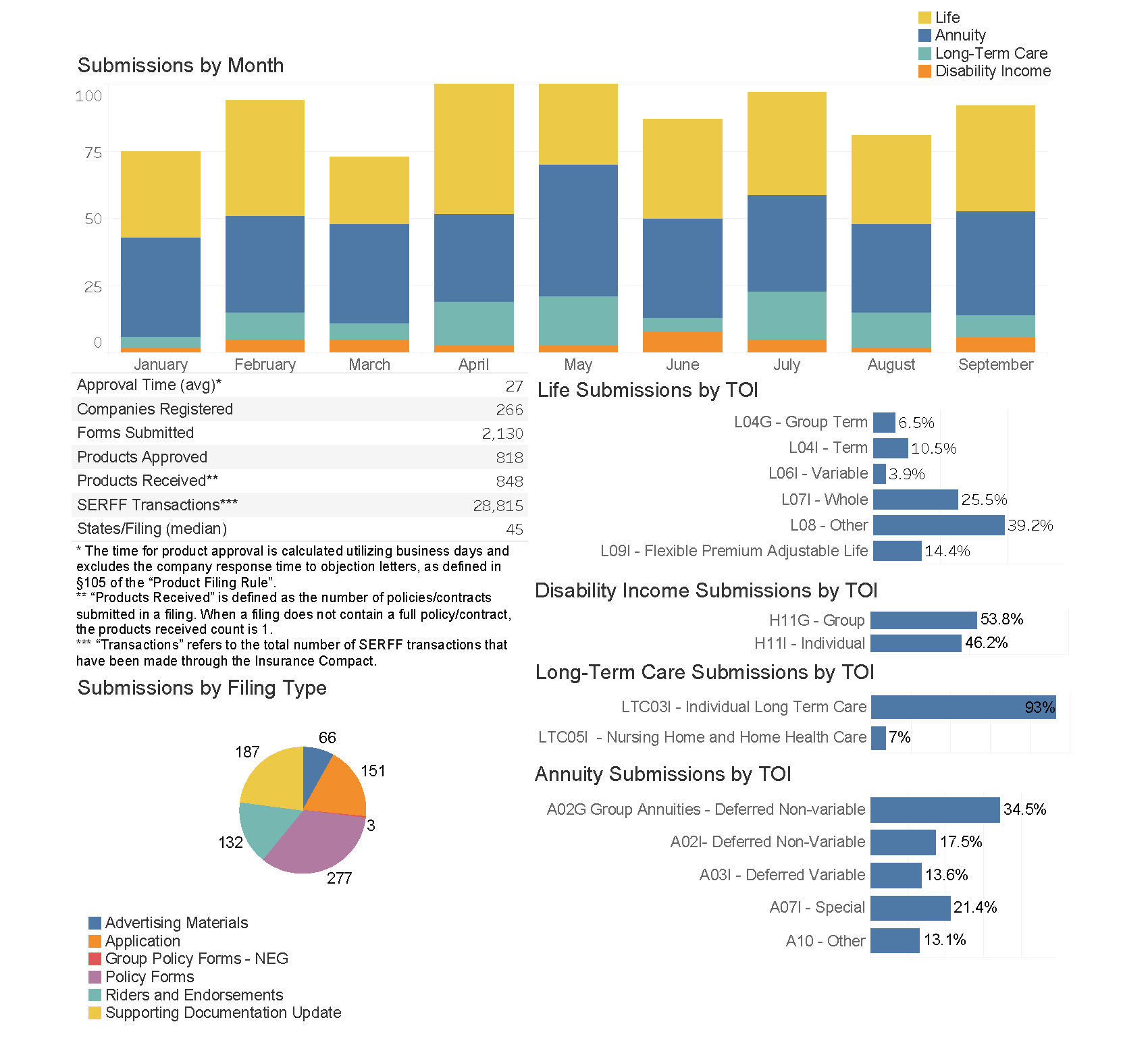

Compact Product Filing Statistics

as of September 30, 2025