In this issue

1101 K Street,

NW, Suite 650

Washington DC 20001

(202) 471-3962

www.insurancecompact.org

Follow us on Social Media!

LinkedIn: @Insurance-Compact

Twitter: @InsCompact

Letter from Karen Schutter, Executive Director

Season’s greetings from the Compact! It’s hard to believe 2025 is already coming to a close. This final issue of the Compact Chronicles celebrates the many accomplishments of our members this year and sets the stage for an exciting 2026.

We’re proud to share the 6th annual report highlighting annual and triennial rate schedule certifications for Compact‑approved individual long‑term care insurance products. You can find the public report on our website under Regulator Resources, and confidential state‑specific reports will be sent to participating members in January.

Our Committee surveys are out now! They only take a few minutes, and your feedback helps us make the committee process even better in 2026. If you’re on a committee but haven’t received the survey, please drop us a note at comments@insurancecompact.org.

As the holidays approach, we wish you joy, rest, and time with loved ones. The Compact Office will be closed from December 25 through January 1, with staff checking in occasionally. We’ll be back to full operations on Friday, January 2, ready to tackle new goals and continue building success together in 2026.

We are grateful for the opportunity to serve our members, and we are here to provide whatever support they need.

Member Corner

For this edition, we profile New Hampshire Insurance Commissioner D.J. Bettencourt!

David J. (D.J.) Bettencourt was confirmed Commissioner of the New Hampshire Insurance Department effective Sept. 20, 2023. Bettencourt assumed the position of Acting Commissioner, per New Hampshire’s statute, after Commissioner Chris Nicolopoulos did not seek reappointment upon the conclusion of his term.

From 2004 to 2012, Bettencourt served in the New Hampshire House of Representatives, focusing on tax, education, and insurance-related issues. In 2010, he was elected by his colleagues as the youngest majority leader in state history. He was nominated for the position of Deputy Commissioner of the New Hampshire Insurance Department by Commissioner Nicolopoulos and approved by Gov. Christopher T. Sununu (R-NH) in January 2021. Previously, Deputy Commissioner Bettencourt served as Gov. Sununu’s Policy Director from 2017 to 2021, including as the Governor’s liaison to the Insurance Department.

Bettencourt earned two bachelor’s degrees in political science and communication, with a minor in philosophy from the University of New Hampshire (Durham, NH) in 2007. He then earned a Juris Doctor (J.D.) from the University of New Hampshire School of Law in 2015.

Fall National Meeting Recap

The Management Committee and Commission approved amendments to several Group Annuity Uniform Standards, including those for Group Fixed Annuity Contracts, Group Guaranteed Interest Contracts for Non-Variable Annuities, and Group Annuity Certificates. These updates followed additional public hearings and stakeholder feedback since their initial consideration in August. To address concerns, the Compact Office recommended clarifying language to ensure that insurers offering employer plans under ERISA remain subject to the same approval process as non-employer groups under state law. The Compact Office will promulgate the amended standards on January 6, 2026, and the effective date for filing is April 6, 2026.

The Commission also adopted a new “direct final rule” process. Under this provision, the Management Committee may use direct final rulemaking for proposals it expects to be noncontroversial. Such rules must be published on the Commission’s website with a statement explaining that they will take effect 60 days after publication if no objections are received. If no objections are filed within that period, the rule becomes final. However, if an objection is submitted, the rule does not take effect, and the Management Committee must notify the Commission and proceed through the standard rulemaking process. The Compact Office promulgated the amendment to the Operating Procedure on December 17, 2025, and the effective date is February 2, 2026.

The 2026 annual budget and fee schedule were adopted, with no increase in filing fees. The budget also included approval for additional staff positions, reflecting the Commission’s growth and the expanding scope of its work. Alongside this, the Commission adopted the 2026 prioritization plan for Uniform Standards development, as recommended by the Product Standards Committee.

The Adjunct Services Committee reported on a new pilot framework that gives states a collaborative forum, facilitated by the Compact Office, to review company product concepts before they are filed individually. The process uses the Compact’s product and actuarial expertise to provide advisory guidance, helping companies address state‑specific concerns early and reducing the need for multiple presentations. Three frequent filers with products outside current Uniform Standards have volunteered, and all Compacting States have been invited to participate. At the recent Roundtable in Omaha, video vignettes demonstrated how the process works and were well received; these will be shared more broadly with committees. The Compact Office has emphasized that confidentiality protections apply, and states are encouraged to respond to the invitation ASAP so the pilot can begin in early 2026.

The Commission also conducted its year-end business during the Annual Meeting:

- Confirmed the composition of the Management Committee and adopted committee assignments in accordance with its bylaws.

- Officer elections were also held, resulting in the selection of the Chair, Vice Chair, and Treasurer for the 2025–2026 term. The 2025 officers will continue to serve for 2026: Nebraska Department of Insurance Director as Chair, West Virginia Insurance Commissioner Allan McVey as Vice Chair, and Maryland Insurance Commissioner Marie Grant as Treasurer. Rhode Island Department of Business Regulation Director Elizabeth Kelleher Dwyer will continue as Past Chair.

- The meeting concluded with the adoption of the consent agenda, which included reports from the Audit, Product Standards, and Rulemaking Committees, the Annual Treasurer’s Report, the Executive Director’s Operational Report, and minutes from prior meetings.

Meeting Highlights

2025 Compact Highlights

Before we welcome 2026, here is a look back at what we have accomplished this year!

Uniform Standards and Operating Procedures

The Commission adopted several new and amended Uniform Standards:

- Uniform Standards for Riders, Endorsements or Amendments Used to Effect Group Annuity Contract Changes

- Uniform Standards for Riders, Endorsements or Amendments Used to Effect Group Annuity Certificate Changes

- Additional Standards for Forms Used to Provide Tax Qualified Plan Provisions for Group Annuity Contracts

- Additional Standards for Graded Death Benefit for Group Term Life Insurance Policies and Certificates

- Additional Standards for Waiver of Premium Benefits for Total Disability and Other Qualifying Events for Group Term Life Insurance Policies and Certificates

- Additional Standards for Forms Used to Provide Tax Qualified Plan Provisions for Group Life Insurance Policies

- Group Fixed Annuity Contract Uniform Standards

- Uniform Standards for Group Guaranteed Interest Contracts for Non-Variable Annuities

- Group Annuity Certificate Uniform Standards

The Rulemaking Rule was also amended to accommodate a new “direct final rule” process.

Life Insurance Training

In fall 2025, the Compact Office launched its first insurance product training program—the Life Insurance Product Training series—to help regulators strengthen their review of life insurance products. The sessions covered regulatory fundamentals, practical examples, and key concepts from insurance forms and contracts, fulfilling a major goal of the member‑adopted strategic plan. The full series is now available on NAIC Connect with recorded webinars and slide decks for on‑demand viewing. This successful rollout paves the way for upcoming training on annuities, disability income, and long‑term care products.

Regulatory Affairs Division

In July, the Compact Office welcomed Dan Bradford as the new Director of Regulatory Affairs, a position newly authorized by the Commission to lead a dedicated regulatory affairs team. This team is focused on committee staff support, member communications, state training and outreach, and includes three current staff members—all former regulators—Sarah Neil, Sue Ezalarab, and Cara Shackelford. Each member of this team has 11 states assigned to them, serving as the primary contact with the Compact. Through one-on-one sessions, they reviewed pressing issues, ensured states were receiving information smoothly, and answered questions to strengthen communication and support across jurisdictions.

Compact Roundtables

In 2025, the Insurance Compact held two Roundtables that highlighted both the strengths of its one‑stop review system and areas for improvement. At the May Roundtable in Washington, D.C., participants praised the Compact’s efficiency, consistency, and communication, while also noting challenges around staffing, training, and adapting standards for innovative products. Stakeholders showed strong interest in the proposed Consultation Advisory Services but sought clarity on how it would work in practice.

The November Roundtable expanded on this with vignettes demonstrating early engagement, pre‑filing consultations, and collaborative multi‑state reviews. Discussions emphasized confidentiality and the value of advisory reports in promoting more uniform, efficient filings and supporting smaller states. Together, the two events underscored a shared commitment to refining the Compact’s processes to enhance modernization, regulatory efficiency, and consumer protection.

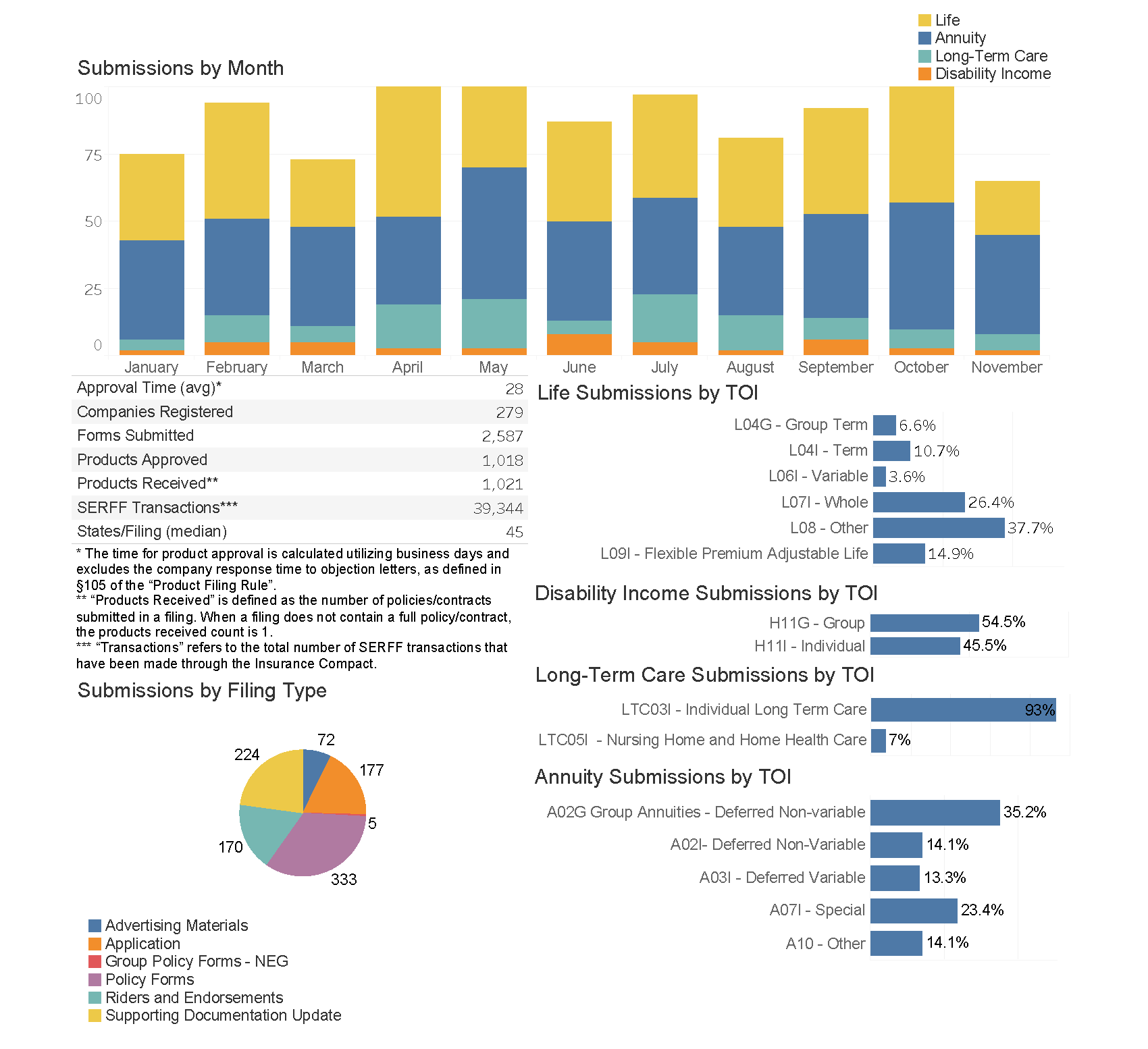

Compact Product Filing Statistics

As of November 30, 2025