In this issue

1101 K Street,

NW, Suite 650

Washington DC 20001

(202) 471-3962

www.insurancecompact.org

Follow us on Social Media!

LinkedIn: @Insurance-Compact

Twitter: @InsCompact

Letter from Karen Schutter, Executive Director

Greetings from the Compact! As we begin 2026, we also recognize a significant milestone: the 20th anniversary of the Insurance Compact, which held its inaugural meeting in June 2006. What began as a shared vision among states to improve efficiency and uniformity in product regulation has, over two decades, become a durable and evolving regulatory framework. This anniversary year offers a moment to reflect on that progress while looking ahead to how the Compact can continue to adapt and serve its members in the years to come.

The Compact begins 2026 with strong momentum and renewed focus on the work ahead. Planning discussions with our Officers and Committee Chairs and Vice Chairs are already underway, and committees are preparing for full and thoughtful agendas in the months ahead.

That momentum was reflected in the Officers’ planning meeting on January 16, where the group took stock of a year of solid financial performance and steady progress across key initiatives, alongside continued evolution in how we engage and support our members. Looking ahead, officers emphasized deeper commissioner engagement, clearer strategic direction to committees, and deliberate prioritization as the Compact members address increasingly sophisticated policy questions.

The Compact Office is preparing to launch a pilot of its newly renamed Compact Center of Expertise within the next few weeks. Through this pilot, a small number of companies will participate in facilitated, collaborative consultations with interested member states on prospective products or benefit features prior to filing. The pilot is designed to support early, confidential dialogue, allow states to identify questions or concerns upfront, and ultimately promote more efficient and informed state-by-state review when formal filings occur.

We are grateful for the opportunity to serve our members, and we are here to provide whatever support they need.

Member Corner

For this edition, we profile Vermont Insurance Commissioner Kaj Samsom!

Kaj Samsom was appointed Commissioner of the Vermont Department of Financial Regulation (DFR) on April 14, 2025. Prior to his appointment, he served as chief auditor at National Life Insurance Group.

Commissioner Samsom brings extensive experience in state and local government, having held a range of roles throughout his career. He began his public service in 2006 with the Insurance Department’s Licensing and Examinations section. In 2011, he was named chief examiner, followed by his appointment as deputy commissioner of insurance in 2014. He left the Insurance Division of the DFR in 2017 when he was appointed tax commissioner by Gov. Phil Scott.

Commissioner Samsom has held leadership roles on several boards, including serving as chair of the Moretown School Board and chair of the Vermont Society of Certified Public Accountants (VTCPA). He also served on the Vermont Board of Public Accountancy.

A certified public accountant, Commissioner Samsom earned both his bachelor’s degree and master’s degree in public administration from the University of Vermont.

Compact Happenings

2026 Committee Chairs & Vice Chairs

Actuarial Working Group

Director Judith French, Chair - Ohio

Commissioner Jon Pike, Vice Chair – Utah

Adjunct Services Committee

Director Angela Nelson, Chair - Missouri

Director Chuck Bassett, Vice Chair – Arizona

Audit Committee

Commissioner Sharon P. Clark, Chair - Kentucky

Commissioner Ned Gaines, Vice Chair – Nevada

Finance Committee

Commissioner Marie Grant, Chair - Maryland

Commissioner Allan L. McVey, Vice Chair - West Virginia

Governance Committee

Commissioner Eric Dunning, Chair - Nebraska

Commissioner Allan L. McVey, Vice Chair - West Virginia

Product Standards Committee

Commissioner Doug Ommen, Chair - Iowa

Commissioner Kaj Samsom, Vice Chair – Vermont

Rulemaking Committee

Director Larry Deiter, Chair - South Dakota

Superintendent Robert Carey, Vice Chair - Maine

Rulemaking Committee

The Rulemaking Committee held a well‑attended public call to gather stakeholder input on a proposed Intermediate Review Process, a new procedure that would give filers a formal avenue to challenge the application of a uniform standard while a product filing is still under review. More than 60 participants joined, representing Compacting states, advisory committees, and industry groups. Committee leadership explained that the process was developed at the direction of the Management Committee to address disputes before final disposition of a filing.

Under the proposal, filers—after first attempting resolution with the Compact Office—could request review by a Member Review Board composed of commission members. The process outlines submission requirements, timelines, a review fee, and issuance of a written report; final reports would be shared with the filer and Compact Office and made public with confidential information redacted. Industry participants raised questions about timing, procedural mechanics, and implementation. Committee members confirmed that reviews could take 30 days or up to several months, and that filings would remain on hold during that period, though filers could withdraw a request. Additional clarifications covered electronic submissions, limits on late‑stage information, and confirmation that each filer may seek review even when similar issues have been addressed previously.

Regulators expressed strong support, noting that the proposal fills a long‑recognized gap and provides greater transparency and due process while helping resolve disputes without withdrawal or state‑by‑state filings. The Committee plans to incorporate feedback, refine the proposal as necessary, and vote on a final recommendation for submission to the Management Committee at the national meeting in March.

Compact Spotlight

Meet Nick Boukas!

Nick Boukas joined the Interstate Insurance Product Regulation Commission (“Insurance Compact”) as an Actuary on January 5th, 2026. Nick’s primary responsibility is to review actuarial memoranda submitted with product filings to the Insurance Compact for compliance with the actuarial requirements as established in the Insurance Compact Uniform Standards, with focus on life insurance filings, but will also assists with annuity and LTC filings.

Nick is a credentialed actuary with over 30 years of diversified actuarial expertise acquired in the life insurance industry for US and Canadian based Fortune 500 companies. Nick has expertise in experience studies, assumption development/review, actuarial audit, actuarial financial reporting/analytics, and actuarial system modernization. His background includes working for several insurance companies and serving many life insurance clients as an actuarial consultant for the life insurance industry.

Nick has worked with a wide range of product lines; individual life, annuity, retirement and group life/health and individual/group LTC. Nick also has over 20 years leading and managing a variety of different departments and projects for life insurance companies and clients.

Nick is a graduate of the Concordia University of Montreal, Quebec, Canada, with a Bachelor of Science Actuarial Mathematics. Nick has earned the ASA designation and is Member of the American Academy of Actuaries (MAAA).

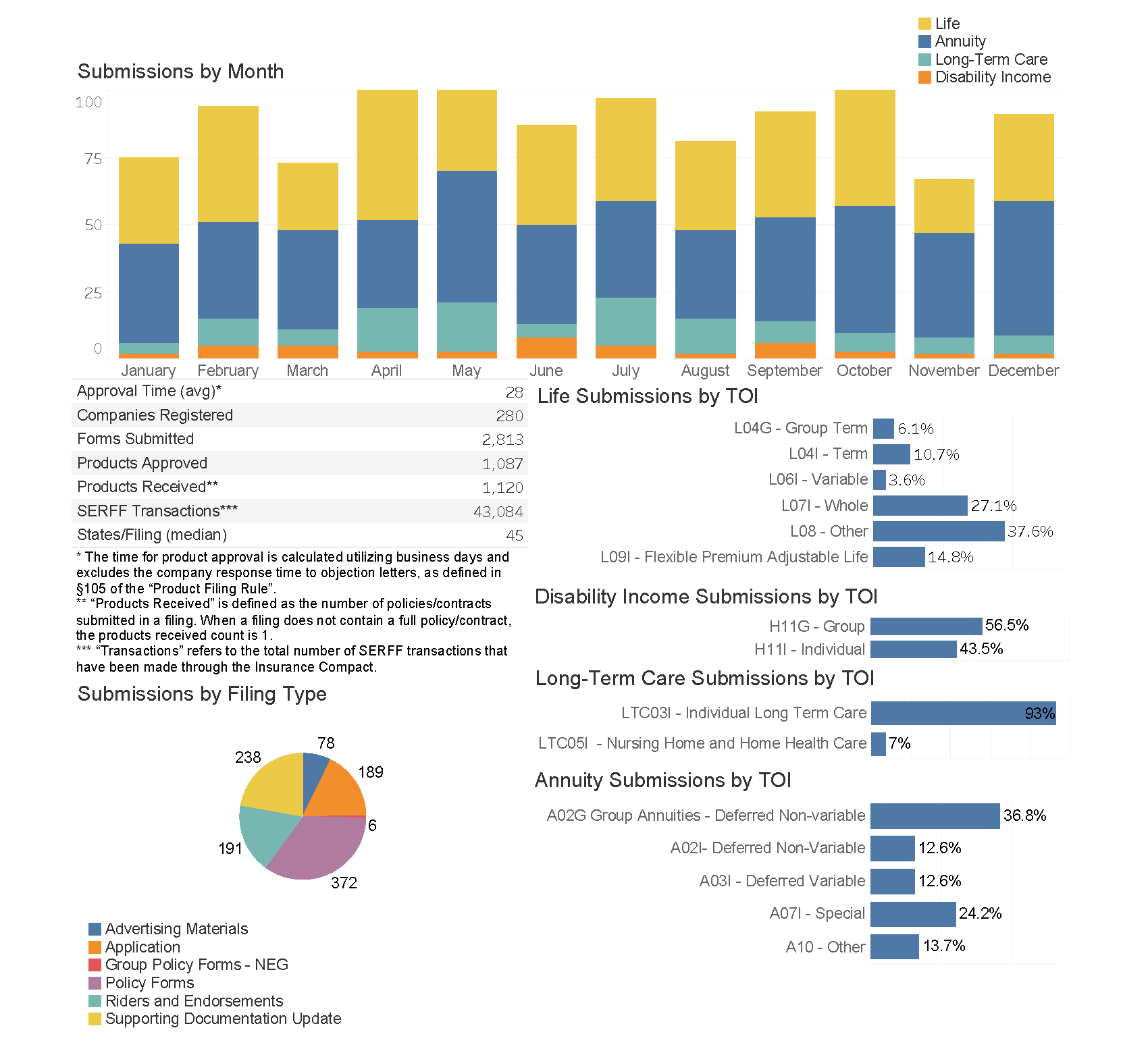

Compact Product Filing Statistics

as of December 31, 2025