In this issue

1101 K Street,

NW, Suite 650

Washington DC 20001

(202) 471-3962

www.insurancecompact.org

Follow us on Social Media!

LinkedIn: @Insurance-Compact

Twitter: @InsCompact

Letter from Karen Schutter, Executive Director

Welcome to our July newsletter and the heat of summer. I hope you are finding relief whether in the cool of air conditioning, lounging at the water, or chilling over an interesting insurance topic.

We are getting ready for the Joint Meeting of the Management Committee and Commission in Minneapolis, MN next month. It is a hybrid meeting scheduled for August 12, 2025, at 9:45 am CT. We hope to see each Compacting State in person, but there is a WebEx link on the Events page of the Compact’s website for those joining us virtually.

We have cool news from the Compact Office. First, I would like to welcome Dan Bradford as our new Director of Regulatory Affairs and Counsel. Before joining us, Dan worked at the Ohio Department of Insurance for seven years, serving as Associate General Counsel during his last three years. You may know Dan as he has served as Ohio’s Compact designated representative for Director Judith French and will lead our new Regulatory Affairs Team. Serving on this team will include our superstar team of former regulators including Susan Ezalarab, Regulatory Consultant; Sarah Neil, Communications and Outreach Coordinator; and, Cara Shackelford, Regulatory Research Specialist. Dan and this new team focus on delivering excellent committee support, responsive member state relations, and in-depth regulator training and support.

We have promoted three long-serving team members. Becky McElduff, who joined the Compact Office in 2014 after 10 years of service in the NAIC Legal Division, has been promoted to Chief of Operations and Chief Counsel. Sara Dubsky, who is the longest serving employee joining the Compact Office in 2007, has been promoted to Chief of Staff. Karen Givens, who has been in the Compact Office’s product operations since 2011, has been promoted to Director of Product Operations.

Becky oversees and optimizes the Compact Office operations and develops and executes operational strategies that deliver efficiency, productivity, and sustainable growth for the members, company filers, and stakeholders. Sara maintains the administrative operations managing the annual governance calendar, the budget and financial reporting process, and organizational notices and communications. Karen supervises the Compact Office’s product operations to ensure quality, responsiveness and consistency in the product filing review process.

Please join me in welcoming Dan and congratulating Becky, Sara, and Karen. I am proud of our entire team of stellar professionals who are centered on delivering superior member service to our Compacting States, exceptional customer service to our company filers, and productive engagement with all stakeholders.

We are grateful for the opportunity to serve our members, and we are here to provide whatever support they need.

Member Corner

For this edition, we profile District of Columbia Insurance Commissioner Karima Woods!!

Karima Woods has served as the Commissioner of the DC Department of Insurance, Securities and Banking since July of 2020. The Council of the District of Columbia confirmed Woods as Commissioner on July 28, 2020.

Woods is the chief regulator for the District’s financial services industries, including insurance companies, captive insurance companies, investment advisors, securities broker dealers, mortgage loan originators, mortgage lenders and brokers, state-chartered banks, student loan servicers and money transmitters. The Commissioner is also responsible for managing financial empowerment and access to capital programs. In fiscal year 2025, the Commissioner oversees the Department’s $36.4 million budget, 152 employees and approximately $234 million in projected revenue.

Woods is the National Association of Insurance Commissioners Co-Vice Chair of the Innovation, Cybersecurity, and Technology (H) Committee.

Woods holds a Master of Business Administration from George Washington University, and a Bachelor of Arts in law and society from the University of California at Santa Barbara.

Woods is married and a proud parent of two college-aged daughters and lives in Washington DC.

Committee Updates

Product Standards Committee (PSC)

The PSC met in a regulator-only meeting on July 15, 2025. The meeting focused on reviewing proposed new and amended Uniform Standards for 2026, as well as carryover items from 2025. Some of the 2026 proposals included technical updates from ACLI, a new standard for protected income solutions, and requests for standards related to group annuity contracts, structured settlement annuities, and wellness benefits tied to annuity products. Some proposals, such as a critical illness policy, were flagged as potentially outside the Compact’s scope.

The committee also reviewed ongoing 2025 priorities, including amendments to Index-Linked Variable Annuity standards, waiver of premium and surrender charges, and distinctions between participating and non-participating products. Additionally, the committee discussed the need for informational sessions and possibly a survey on paid family leave, recognizing that administration of such programs varies widely across states. A public call is scheduled for August 5 to gather industry feedback on what should be prioritized for 2026. At the public call, the PSC is seeking comments on the type and reasons for additional triggers for waiver of life insurance premiums and waiver of annuity surrender charges.

Rulemaking Committee

The Insurance Compact Rulemaking Committee held a public meeting to discuss and receive comments on proposed rulemaking recommendations for 2025. The committee provided an overview of its revised work plan, which shifted focus from "mix and match" issues to accelerated rulemaking and appeals procedures. The primary recommendation was the inclusion of a "Direct Final Rule" provision, modeled after the 2010 Model State Administrative Procedures Act. This rule would allow for expedited adoption of non-controversial amendments or new standards. The committee emphasized that this approach would streamline the process for routine updates, freeing up resources for more complex matters.

Additional discussions addressed the concept of "negotiated rulemaking," also from the 2010 model act. While some states use similar consensus-based approaches, the committee concluded that existing subgroup processes—such as those used for index-linked variable annuities and disability income standards—already serve this purpose effectively. Therefore, no changes were recommended. The committee also evaluated the need for a formal appeals process for challenging Compact Office interpretations of Uniform Standards. After reviewing current procedures, including informal hearings and the issuance of advisory and interpretive opinions, the committee determined that sufficient mechanisms are already in place, so no further amendments are necessary. With no written or oral objections raised during the meeting, the committee agreed to forward its recommendations to the Management Committee for consideration at the upcoming in-person meeting in Minneapolis on August 12.

Adjunct Services Committee

The Adjunct Services Committee held a public call on July 24, 2025, to review progress on the proposed Consultation and Advisory Services Office (CASO) and to gather feedback on a pilot program framework. The updated framework, renamed from the “Innovation Office” to better reflect its purpose, aims to provide a collaborative platform for compacting states to consult on complex product filings that fall within the Compact’s authority.

The proposed pilot program would test the framework’s effectiveness, with eligibility criteria including participation from at least 30 states and companies that are already compact filers with experience submitting at least two products. Products eligible for the pilot would include those previously turned away due to scope limitations or those on the Compact’s prioritization list. No oral comments were received; however, the committee welcomed written submissions and plans to brief the full Commission at the August 12 in-person meeting with the goal of commencing a pilot this fall.

Legislative Spotlight

Meet Oklahoma State Representative Ellyn Hefner!

Representative Ellyn Hefner has a diverse career background that includes owning a business, working as a health coordinator with the Oklahoma Family Network, a non-profit that supports families who have a child with a disability, a Financial Advisor, and a Chartered Special Needs Consultant. In that role, Rep. Hefner helps families plan their retirement by creating a financial plan which includes a plan for their child with a disability including government benefits, special needs trusts and social security. Additionally, she has served as the Chairman of the board of the Daily Living Centers in Oklahoma City, President of the Sotos Syndrome Support Association International.

Representative Hefner became more involved in public policy efforts after graduating in 2013 from Partners in Policymaking, a leadership training program designed to teach individuals with disabilities and family members the power of advocacy to positively change the way people with disabilities are supported, viewed, taught, live and work. She is a LEND fellow, Oklahoma Leadership Education in Neurodevelopmental and Related Disabilities, an interdisciplinary leadership education program funded by the federal Maternal and Child Health Bureau in the US Health Resources and Services Administration. She has also served on the Oklahoma State Developmental Disabilities Services (DDS) advisory committee which provides input on DDS policy proposed by the Department of Human Services. Most of her advocacy is held in the disability realm, where she has served as an ambassador for Oklahoma's ABLE accounts with the State Treasurer's office.

Currently, she serves on The Santa Fe Family Life Center Board and development committee in Oklahoma City. The SFFLC is an all-adaptive sports and fitness center. She is a member of Our Lady of Perpetual Help Catholic Church. In her spare time, Hefner sweep rows with The River Sirens on The RIVERSPORT Corporate Rowing League.

Representative Hefner serves on the Health and Human Services Oversight Committee, Insurance Committee, Energy Committee, A&B finance Sub Committee, Rules Committee and Select Committee to Review Mental Health Finances. She serves as a co-chair of the Heartland Caucus, launched by Heartland Forward, which brings together top public policy decision makers focused on health care in eight states - Arkansas, Indiana, Kansas, Kentucky, Louisiana, Missouri, Oklahoma, and Tennessee.

Representative Hefner is also a member of the budget and executive committees for NCOIL: National Council of Insurance Legislators and serves as Vice Chair of the Joint State-Federal Relations & International Insurance Issues. Representative Hefner is a member of the Democratic Party and was elected to the Oklahoma House of Representatives to represent District 87 in the general election on November 5, 2024, to serve a second term, and was elected Caucus Vice Chair-elect for the 61st legislative session.

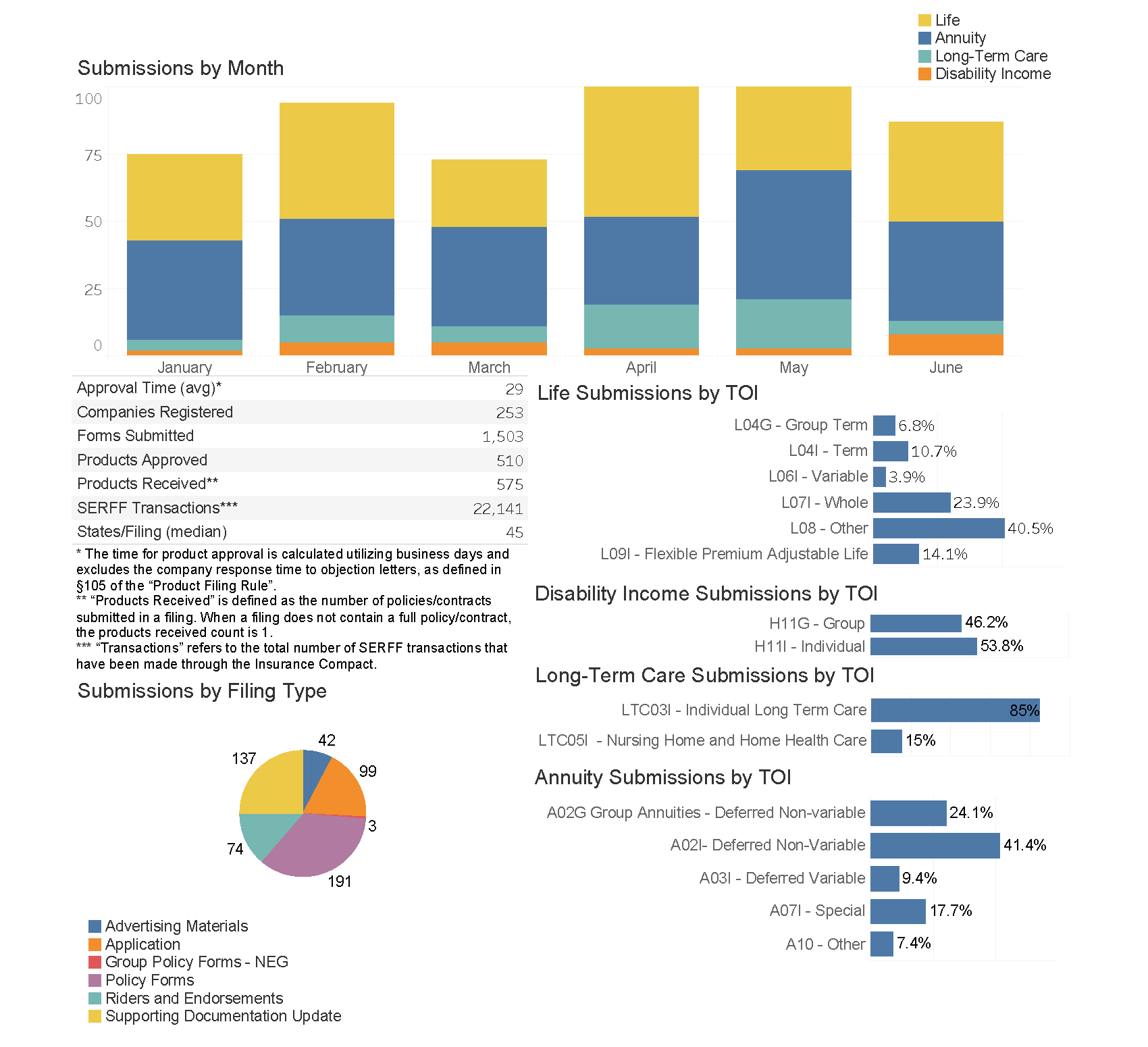

Compact Product Filing Statistics

As of June 30, 2025