In this issue

1101 K Street,

NW, Suite 650

Washington DC 20001

(202) 471-3962

www.insurancecompact.org

Follow us on Social Media!

LinkedIn: @Insurance-Compact

Twitter: @InsCompact

Letter from Karen Schutter, Executive Director

Greetings from the Compact! Thanksgiving is on Thursday, and we’re reminded of the power of community and collaboration. This season, we are especially grateful for our 48 member states whose dedication and partnership make our shared mission possible. Together, we’ve built a network that strengthens our work and amplifies our impact across the nation. Thank you for being an essential part of this journey.

As we near the end of the year, there’s still important work ahead. Chief among these is our Management Committee call on December 2. The Annual Meeting of the Commission is scheduled for Wednesday, December 10 at 10:30 a.m. ET in Hollywood, FL. Prior to that, a Joint Meeting of the Management Committee and Legislative Committee will begin at 10:00 a.m. ET. All Commission members and legislators attending the NAIC Fall National Meeting are welcome to participate. Full agendas for both meetings are available on the Events page of the Compact website.

Do you want a quick overview of what’s on each meeting’s agenda? The Compact Office is hosting regulator-only prep calls to get ready for all three December meetings—and there’s still time to register! Visit the Events page for details. Prefer to catch up later? Log in to NAIC Connect to watch the recording on demand. (Note: NAIC Connect is for regulators only.)

Earlier this month, the Compact Officers hosted their eighth Roundtable event in Omaha, NE on November 5. We extend our sincere thanks to Commissioners Grant and Pike, Directors Dunning, Dwyer, Deiter, and Nelson, along with regulators from Arizona, Connecticut, Delaware, Iowa, Maryland, Nebraska, North Dakota, Ohio, South Dakota, Vermont, and Washington, as well as consumer and industry representatives for their participation. A high-level recap of this important discussion is included in this issue.

We are grateful for the opportunity to serve our members, and we are here to provide whatever support they need.

Compact Roundtable Recap

Participants watched a series of vignettes outlining how the Consultative Advisory Services Office will work.

Vignette 1 – Company discusses new product.

Company representatives emphasized the importance of introducing Compact standards early in the product development process to minimize state-by-state variations. Companies often involve marketing, legal, actuarial, underwriting, and compliance teams early, while administrative systems teams join later. Some companies prefer filing through the Compact when standards exist, as it reduces complexity and accelerates speed to market. However, for regionally tailored products or features outside existing standards, companies may still pursue state-by-state filings. Overall, the vignette reflected real-world practices and highlighted the value of proactive engagement with regulators.

Vignette 2 – Company meets with Compact Office.

This vignette focused on pre-filing communications. Companies see pre-filing as a way to identify objections early and avoid wasted effort on product designs that may not be viable. They appreciate the opportunity to “float” ideas and receive feedback before committing resources. Regulators noted that when they have a pre-filing conversation with the company, it helps them collaborate and share consistent guidance, but they stressed that companies should research state law and regulations first to make discussions productive. Confidentiality emerged as a major concern, with companies worried about sharing proprietary information too soon and questioning which laws would protect trade secrets during this process.

Vignette 3 – Compact Office facilitates meeting with member states and company.

The discussion highlighted the operational aspects of collaborative reviews. Initial meetings typically involve rates and forms teams, with legal and other specialists joining as needed. Regulators find these sessions most useful when companies provide detailed information and anticipate objections upfront. Companies value clear, actionable feedback that helps them develop more uniform forms and avoid waves of late-stage changes. Both sides agreed that having multiple states participate simultaneously is efficient and fosters consistency. Concerns were raised about variability in state interpretations and the time required to coordinate these meetings.

Vignette 4 – Compact Office holds debrief call with member states.

The final vignette explored the benefits of a consolidated advisory report. Companies see the report as a roadmap that helps them tailor filings and avoid redundant questions across states. Regulators appreciate reports that include all questions and answers, as well as actuarial analysis, because it supports smaller states lacking in-house expertise. Confidentiality was again emphasized, with participants wanting clear protections for proprietary information. Both regulators and companies agreed that the process should remain advisory rather than an approval mechanism, but they expect it to improve speed to market, enhance uniformity, and reduce inefficiencies.

Compact Roundtable Highlights

Committee Updates

Product Standards Committee

The Products and Standards Committee (PSC) convened on November 18 to continue discussions on proposed amendments to the Individual Deferred Paid-Up Non-Variable Annuity Standards. The PSC also reviewed ACLI’s November 17 comment letter on the amendments to the Accidental Death and the Accidental Death and Dismemberment uniform standards. The PSC asked the Compact Office to draft proposed language for review.

The next PSC call is scheduled for December 2.

Adjunct Services Committee

The Adjunct Services Committee met on November 17 to review progress on the pilot for the Compact’s new Consultative and Advisory Services initiative. This program, introduced at the August Commission meeting, aims to create a collaborative space where regulators and companies can engage early on product concepts before formal filings. The committee viewed a series of vignettes originally presented at the Compact Roundtable, illustrating how the process works—from initial company outreach to regulator feedback and preparation of an advisory report. Feedback from the roundtable highlighted strong industry interest in the initiative, with companies valuing the opportunity to address potential compliance issues upfront and regulators appreciating the efficiency and access to actuarial expertise. The committee emphasized that this process is advisory, not an approval mechanism, and discussed confidentiality protections for proprietary information. Three companies have expressed interest in participating in the pilot, and outreach to member states will begin shortly. The group also considered renaming the initiative to better reflect its purpose, with “Consultation Advisory Services Team” emerging as a favored option. The next steps include finalizing confidentiality guidance, inviting states to participate, and launching the pilot.

Compact Spotlight

Meet Dan Bradford!

Dan is the Director of Regulatory Affairs and Counsel for the Interstate Insurance Product Regulation Compact (Insurance Compact). Dan is responsible for developing and overseeing strategies that align with member goals and promote robust member engagement and collaboration.

Prior to joining the Insurance Compact, Dan served as Assistant General Counsel to the Ohio Department of Insurance. In this role, Dan was responsible for managing a team of attorneys that supported the Department’s various divisions, including the Office of Product Regulation and Actuarial Services, Consumer Services, Market Conduct, Policy and Legislation, and the Office of the Executive. During his time with Ohio Department of Insurance, Dan was actively involved in representing the Department with the NAIC and Insurance Compact.

Dan began his career in private practice in Cincinnati, Ohio before taking on an in-house role with a large general agency. Dan earned his Bachelor of Science in Business Administration from Xavier University and a law degree from Northern Kentucky University.

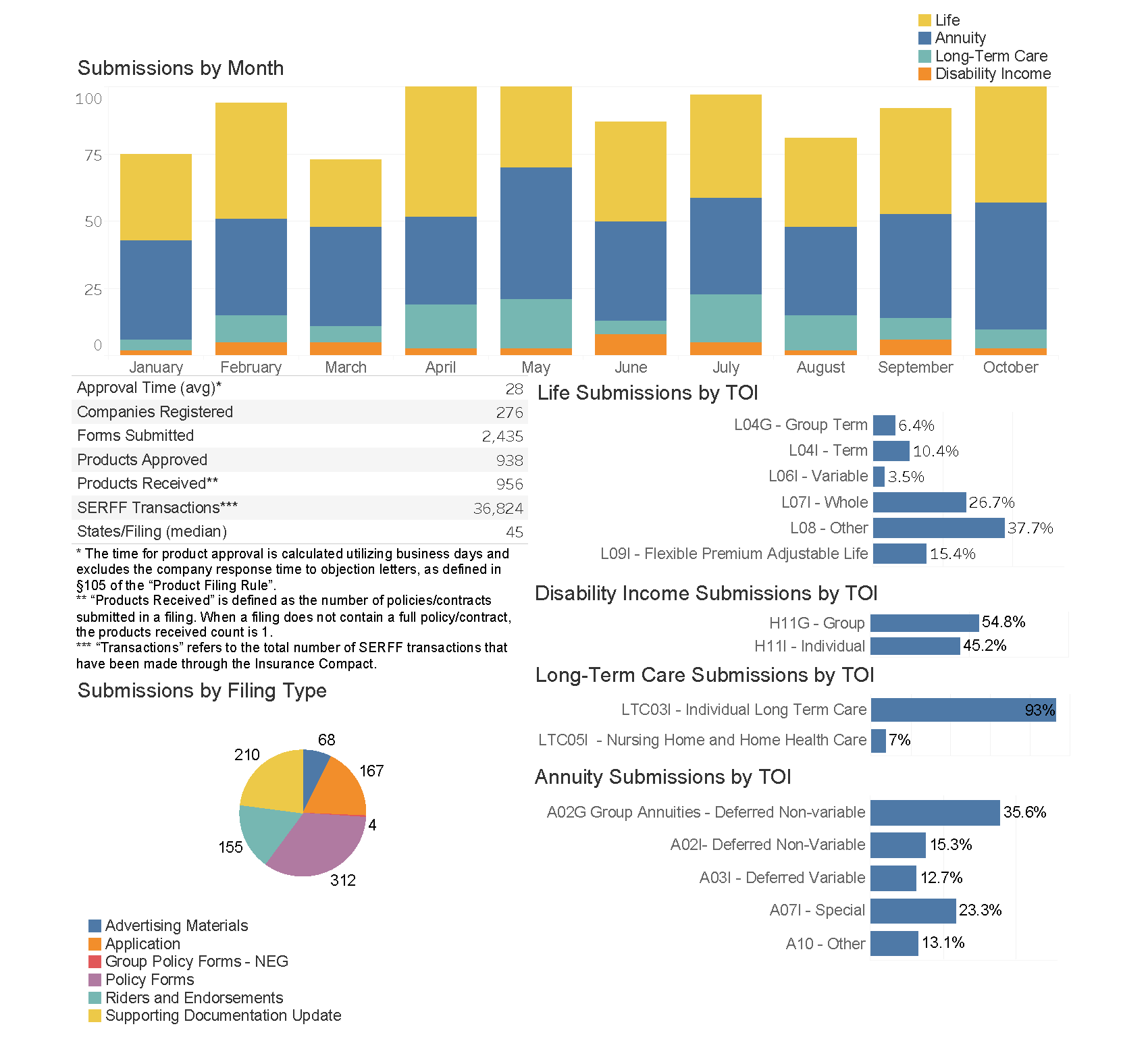

Compact Product Filing Statistics

As of October 31, 2025