For almost 20 years, the Interstate Insurance Product Regulation Compact (Insurance Compact) has brought states together to achieve a common and collective goal of improving insurance product regulation through uniformity and consistency in regulatory requirements and review. With a successful implementation and years of sustained growth in member states, Uniform Standards, filing companies and product approvals, the time is now to set a long-term strategic course for this important organization which serves as an instrumentality of the Compacting States.

The Insurance Compact, its Commission and Insurance Compact Office have evolved beyond their start-up years. With 46 Compacting States and the vast majority of eligible companies of all sizes having Compact-approved products in the marketplace, the Insurance Compact has become woven into the fabric of state-based insurance product regulation for annuities, life, long-term care and disability income insurance.

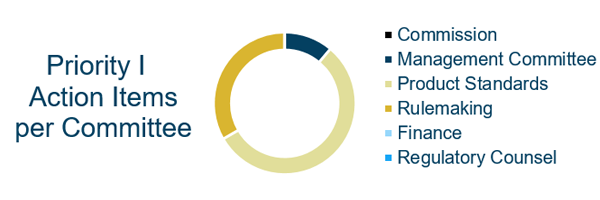

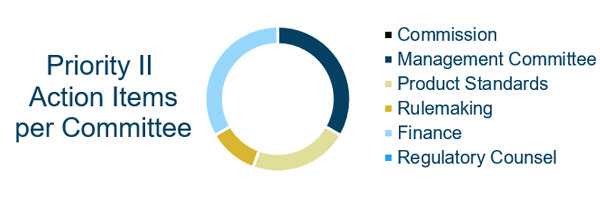

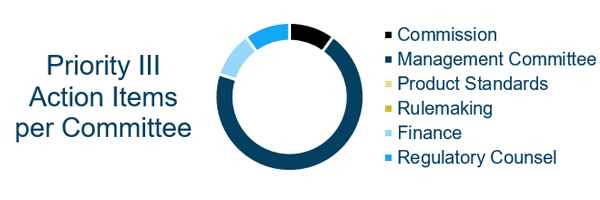

The Insurance Compact's member-driven strategic plan is organized by three overarching priorities supported by nine objectives. The plan further outlines 28 action items to accomplish these priorities and objectives over the coming three years. Read on for more information about each priority and the corresponding obejectives and action items.

The full-lenth strategic plan can be downloaded here.

View the Insurance Compact Navigator for projections of projects related to each action item in the Compass. The Tracker provides a layout of the three-year timeline of all projects. For a snapshot of our progress for the current quarter, see the Dashboard.

|

|

PRIORITY I: Uniform Standards States Support and Companies Willingly Use |

|---|---|

| Objective 1: | Robust – Reflect strong consumer protections |

| Objective 2: | Relevant – Reflect product offerings available in Compacting States |

| Objective 3: | Reasonable – Reflect product requirements that are not unduly prescriptive |

|

|

PRIORITY II: Nationally Recognized Regulatory Review Process |

|---|---|

| Objective 1: | Responsive – Provide prompt review and turnaround times |

| Objective 2: | Reliable – Provide consistent, thorough quality reviews |

| Objective 3: | Regulatory Collaboration – Provide information and processes working with Compacting States to facilitate their state market and financial regulatory functions with respect to Compact-approved products |

|

|

PRIORITY III: Resource for Compacting States, Regulated Entities and Consumers |

|---|---|

| Objective 1: | Responsible – Provide excellent and accountable information and services |

| Objective 2: | Respected – Retain qualified and experienced staff |

| Objective 3: | Ready – Provide proactive information on Compact activities and be an accessible source of information |

|

Strategic Plan Action Items |

||

|---|---|---|

| Priority | Item No. | Action Item (by Committee) |

| Commission | ||

| III. | 10 | Conduct review of the Insurance Compact Bylaws to assess consistency with current governance structure and with governance best practices and solicit feedback from the Compacting States to develop a report and recommendation regarding the effectiveness of the current structure, procedures, communications and opportunities for improvements [in cooperation with the Management Committee]. Independent Governance Review Report Synopsis - Governance Review Governance Review Presentation |

| Management Committee | ||

| I. | 8 | Identify specific areas of product regulation, where uniformity would be conducive to the goals of Compacting States and state-based insurance regulation and determine if they are within the existing authority of the Insurance Compact. |

| II. | 2 | Identify enhancements within the Insurance Compact instance in SERFF or the regulatory review processes to better assist the Compacting States in easily identifying the product, product features and other pertinent information of a Compact filing and work with SERFF to ensure a smooth transition for the Insurance Compact instance during its reengineering project. |

| II. | 3 | Partner with the NAIC to develop automated tools for the Insurance Compact Office, company filers and regulators to create useful reports and search functionality as well as business intelligence to increase consistency and compliance with the Uniform Standards at the time of filing. |

| II. | 9 | Implement an audit process either through an outside party or through participation of regulators in Compacting States to verify randomly selected Compact-approved product filings across product and filing types and companies are subject to consistent, thorough quality reviews for compliance with the applicable Uniform Standards. |

| III. | 1 | Provide regular and ongoing information to Compacting States through weekly, monthly, and quarterly communications and reports about its committee and product operations activities. |

| III. | 2 | Provide live and on-demand training programs and tutorials for Compacting States, company filers, and consumer representatives about various aspects of the Compact and offer ongoing training on Uniform Standards and current product development. |

| III. | 3 | Convene focus groups of Compacting States (regulators and legislators), industry representatives and company filers, and consumers and consumer representatives to identify informational needs and improvements to the website. Focus Group Suggestions and Recommendations for the Insurance Compact Website |

| III. | 4 | Develop a program to create product line discussion groups coordinated by Insurance Compact Office staff composed of interested regulators, legislators, industry and company representatives, consumer representatives and interested parties to discuss current activities and items of interest on a regular basis for the purpose of exchange of information and informed decision making by Compact members. |

| III. | 6 | Engage members and state and federal partners to explore ways to strengthen the legal foundation of the Insurance Compact. |

| III. | 8 | Work with the NAIC to restructure the Commission's repayment of start-up capital to maximize the Commission's ability to balance repayment with sustainability over the next ten years [in cooperation with Audit Committee]. Independent Business Assessment Report Synopsis - Business Assessment Business Assessment Presentation |

| III. | 9 | Working with the NAIC, provide regular updates to Committees, Task Forces and Working Groups with jurisdiction over product lines authorized by the Insurance Compact regarding its activities. Working with other state-based organizations including NCOIL, NCSL and CSG, provide regular updates on the Insurance Compact at its meetings or through other forms of targeted communication. |

| Finance Committee | ||

| II. | 1 | Create a new position for a member services coordinator to work closely with regulators in Compacting States to provide regular and consistent communications on a variety of Compact matters including updates and issues in the regulatory review process. |

| II. | 4 | Provide a continuing path for expedited review for product filings meeting eligibility criteria to optimize compliant filings. |

| II. | 5 | Develop a program to create resource groups of Compacting State regulators with form review or actuarial experience in the Insurance Compact's authorized product lines to train and be available as a resource to the Insurance Compact Office in the regulatory review process. |

| III. | 5 | Develop a comprehensive professional development program for the Insurance Compact Office team to ensure training in current best practices and developments in respective professional fields and creation of a succession planning strategy. |

| Product Standards Committee | ||

| I. | 1 | Provide wider and easy-to-follow public notice and detailed information with respect to Uniform Standards development for members, interested parties and constituents/ stakeholders. |

| I. | 3 | Provide guidance for Compacting States and interested parties to be used in the Uniform Standards development process for drafting, submitting and considering proposals or changes to Uniform Standards to focus on the robust, relevant and reasonable objectives. |

| I. | 6 | Develop a system for identifying and prioritizing the development of new Uniform Standards including for new product lines and new products and benefit features for existing product lines to reflect product offerings accepted by the majority or more of Compacting States. |

| I. | 7 | Develop groups within the Compacting States, state legislators, consumer representatives and industry/company representatives to provide product-specific or issue-specific expertise and feedback to the member regulators in the Uniform Standards development process. |

| I. | 9 | Identify ways that the Uniform Standards can promote the use of plain, understandable language in forms, potentially through a generally applicable Uniform Standard or amendments to individual standards. |

| II. | 6 | Provide samples of simplified forms or provisions deemed consistent with the Uniform Standards for use by company filers when submitting a Compact filing. |

| II. | 8 | Study and provide a recommendation regarding the pros, cons and considerations for the development of a process for working with Compacting States willingly wanting to assist in a coordinated state review of a product filing where aspects of the product may not be able to be approved under current Uniform Standards. |

| Regulatory Counsel Committee | ||

| III. | 7 | Develop reference materials regarding the Insurance Compact to be used as a resource for executive, legislative and judicial branches of government to use in understanding the Insurance Compact. |

| Rulemaking Committee | ||

| I. | 2 | Provide wider and easier participation by all Compacting States in the drafting process for Uniform Standards development including discussions of the Product Standards Committee. |

| I. | 4 | Explore whether to expand the Uniform Standards to accommodate group types available in the Compacting States for the authorized product lines (other than the existing employer-employee group type), and if approved by the Commission, commence development. |

| I. | 5 | Review current five-year review process and activities to recommend changes, while ensuring continued transparency and wide opportunities for member and public input, to make it a more iterative, flexible and efficient review of the Uniform Standards focused on the robust, relevant and reasonable objectives. |

| II. | 7 | Study and analyze the types of Mix and Match for product filings over the last three years and provide a report to the Commission with detailed information and recommendations to improve the process and further minimize the need for Mix and Match and include guidance, with input of Compacting States, regarding whether additional forms are required to be filed with Compacting States for a Compact-approved product. |

Strategic Plan Development History

In 2019, the Insurance Compact Commission undertook a member-driven strategic planning process with the purpose of setting strategic priorities, goals and objectives for the next three years.

After soliciting input and conducting surveys of our members, filers and other stakeholders, the Strategic Planning Committee drafted a Strategic Planning Framework laying out the draft priorities, objectives and goals to serve as a starting point for further discussion.

At an in-person meeting on August 2, 2019, the Commission expressed general agreement with the priorities laid out in the framework. The Strategic Planning Committee exposed a draft Strategic Plan for review and comment by members and interested parties.

The final strategic plan, the Insurance Compact Compass, was approved by the Management Committee and adopted by the Commission following an in-depth discussion at the in-person annual meeting on December 9, 2019.

Comments Received During the Development Process:

- Draft Strategic Plan Summary of Comments (Survey Phase)

- Comments from Jason Lapham, Colorado Division of Insurance, dated June 26, 2019

- Comments from Jackson National Life Insurance dated July 24, 2019

- Comments from Tom Kilcoyne, Pennsylvania Insurance Department, dated July 25, 2019

- Comments from ACLI dated July 29, 2019

- Comments from the Consumer Advisory Committee dated November 15, 2019

- Comments from ACLI dated November 15, 2019

- Comments from the Oregon Division of Financial Regulation dated November 15, 2019

- Comments from the Colorado Division of Insurance dated November 15, 2019

- Comments from the Texas Department of Insurance dated November 20, 2019

Published Drafts:

- Compact Strategic Planning Framework (Approved by the Management Committee & Commission on August 2, 2019)

- Draft Strategic Plan (September 24, 2019)

- Draft Strategic Plan Webinar Presentation

- Draft Strategic Plan Redline - Insurance Compact Compass (Presented to the Management Committee & Commission on December 9, 2019)